The ‘Total Return’ Approach to Retirement Income

The Total Return approach is one of the most common methods retirees use to generate income. Rather than relying on fixed payments or guarantees, this strategy draws income directly from an investment portfolio. It emphasizes long-term growth, flexibility, and a disciplined response to market cycles.

Coordinating what you have already built such as your investments, savings, pensions, and other income sources, will help determine whether this retirement income style works for you.

Key Takeaways

- Uses a diversified portfolio to create income through systematic withdrawals

- Provides flexibility in how much to withdraw each year

- Offers potential for long-term growth but exposes retirees to market fluctuations

- Requires ongoing planning to sustain income and manage taxes over time

How the Total Return Approach Works

The Total Return approach seeks to generate income from the overall performance of an investment portfolio rather than from fixed sources. Retirees typically withdraw a percentage of their portfolio each year, often between 3% and 5%, based on performance, life expectancy, and income needs.

In strong market years, portfolio growth may exceed withdrawals, allowing balances to grow. In weaker years, retirees may need to adjust spending to preserve long-term sustainability. The goal is to balance withdrawals with growth so that assets continue providing income for life.

In today’s lower-yield environment, the Total Return strategy has become even more relevant. Relying solely on interest and dividends may not be enough to meet income needs, so retirees must view their entire portfolio as their source for sustainable withdrawals.

Translating an existing portfolio into a Total Return income plan takes thoughtful coordination. Asset location, tax efficiency, and cash-flow timing all influence how sustainable your withdrawals will be. These are planning decisions, not investment choices.

Advantages of the Total Return Approach

Flexibility: Income can be adjusted annually depending on portfolio returns and personal spending goals.

Growth Potential: Investments remain in the market, allowing participation in long-term economic expansion and inflation protection.

Tax Efficiency: Strategic withdrawals and rebalancing can minimize taxable events, especially when coordinated with Roth conversions or capital gain harvesting.

Liquidity: Assets remain accessible for emergencies, gifting, or legacy goals.

Common Pitfalls

While the Total Return method offers flexibility, it also requires restraint. Withdrawing too much during market downturns can have lasting consequences, a phenomenon known as sequence of returns risk. When portfolio values drop and withdrawals continue, it becomes harder for the account to recover, especially early in retirement.

Example:

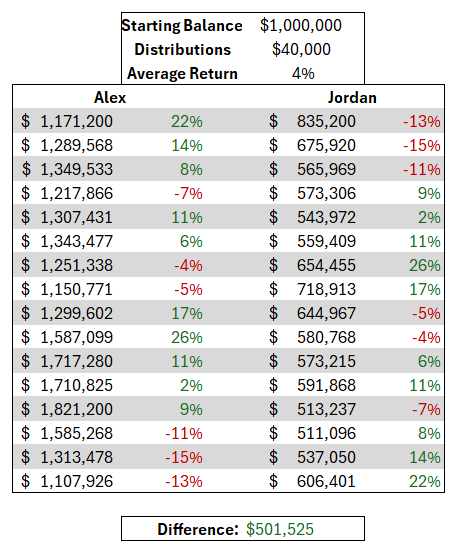

Imagine two retirees, Alex and Jordan. Each starts retirement with $1 million and withdraws $40,000 per year. Both average a 4% annual return over 20 years.

Alex experiences strong markets early on and ends retirement with nearly $1.1 million.

Jordan faces a market downturn in the first three years and ends the 20 years with $600,000

Even though their average returns were identical, Jordan’s early losses combined with withdrawals created a compounding drag that Alex avoided. This is why Total Return strategies often include a short-term cash or bond reserve to avoid selling during down markets.

The 4% rule, a well-known guideline, is a helpful reference point for sustainable withdrawals. Yet no rule of thumb replaces active planning. Market conditions, inflation, and spending patterns can all shift the appropriate withdrawal rate over time.

Determining an appropriate withdrawal rate, building a buffer for volatility, and deciding which accounts to tap first all require ongoing review. Even small adjustments can have a major impact over decades of retirement.

When Expenses Don’t Go According to Plan

Even with a well-structured withdrawal plan, large or unplanned expenses can accelerate portfolio depletion. Healthcare costs, long-term care, and home maintenance often exceed expectations and can force higher withdrawals during inopportune times.

Setting aside a dedicated reserve or using insurance solutions such as Health Savings Accounts (HSAs), long-term care riders, or hybrid life insurance can help protect the portfolio’s long-term integrity. A Total Return plan works best when flexibility is paired with safeguards for life’s unpredictability.

Thinking about using the Total Return Approach?

Ask yourself these questions. If your answers are ‘yes’, this may be an appropriate strategy for you:

Do you have substantial savings and can tolerate short-term market fluctuations?

Do you value autonomy in managing withdrawals and investments?

Do you have long-term legacy goals?

Are you comfortable with variable income in different years?

Implementing a Total Return approach involves more than selecting investments. It requires ongoing coordination between portfolio design, withdrawal strategy, and tax planning.