Tax Concerns for Generational Gifting

Learn how coordinated 529 and UTMA gifting strategies, combined with tax awareness, can support multigenerational wealth planning.

Selling Your Home? Here’s How Taxes on the Profit Work

Learn how the Section 121 home sale exclusion works, including gain limits, ownership rules, exceptions, and how prior use or improvements can affect the taxable outcome.

Weekly: Mixed Markets After Fed Decision

Markets were mixed as investors reacted to earnings results, a steady Fed decision, and economic data. Weekly market insights and key events ahead.

Simeon Esprit: An Interview on Financial Planning and Leading with Intention

An interview with Simeon Esprit on financial planning, habits, and how life experience shapes long-term direction beyond the numbers.

FEGLI Option B: Why Many Federal Employees Pay More Than They Expect

Learn how FEGLI Option B premiums increase with age, why many federal employees overpay for coverage, and which parts of FEGLI often make sense to keep in retirement.

Weekly: Volatility Returns

Markets ended a volatile week slightly lower as investors reacted to policy headlines, economic data, and earnings updates. Weekly market insights and events ahead.

Should I Invest Lump Sums Differently Than Ongoing Contributions?

Should lump sums be invested differently than monthly contributions? Learn how strategy type, volatility, and behavior shape the right approach.

What a Bad Retirement Often Looks Like

What would a bad retirement would look like? Asking this question can help uncover what you hope to void. More importantly, it will help guide you to what you value and what you want your retirement lifestyle to look like.

Weekly: Markets React to Data and Policy News

Stocks moved modestly lower during a volatile week as investors reacted to economic data, policy headlines, and earnings updates. Weekly market insights and events ahead.

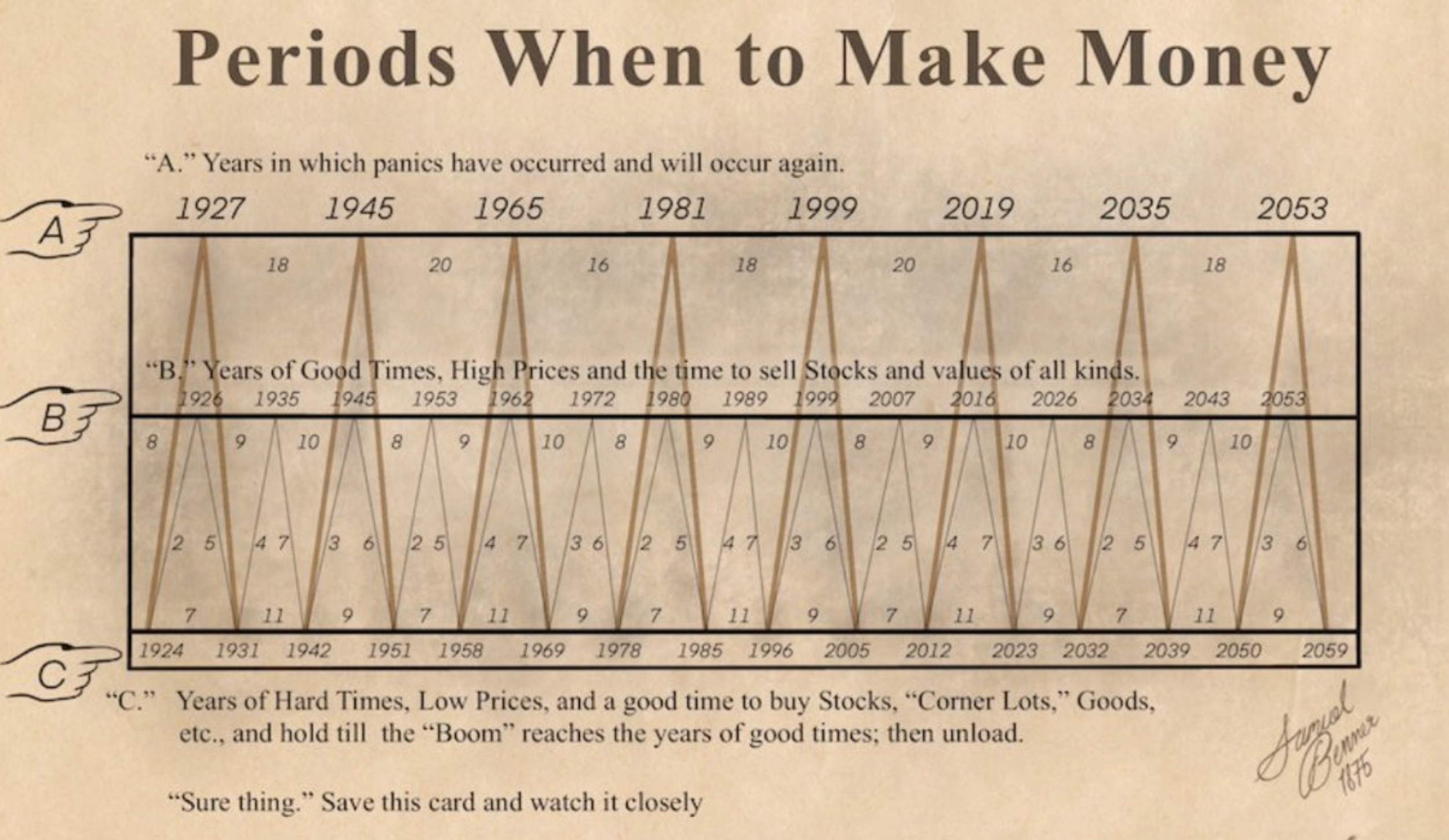

2026 Market Forecasts: A Moving Target

Market forecasts change as assumptions shift. Learn why outlooks are revised, what forecast tables miss, and how preparation matters more than prediction.

Why Federal Employees Retire at Age 57

Age 57 is a popular retirement age for federal employees. Learn how MRA, FEHB, pension rules, and TSP access factor into the decision.

Weekly: Stocks Extend Early-Year Momentum

Stocks finished the week higher as investors reacted to economic data, sector rotation, and shifting interest rate expectations. Weekly market insights and key events ahead.

Are AI Stocks in a Bubble?

AI bubble charts are gaining attention, but visual comparisons can be misleading. Learn what these charts show, what they miss, and how investors should think about market cycles.

Retirement Questions That Have Nothing to Do With Money

Retirement planning is about more than money. Explore key non-financial questions around time, lifestyle, housing, mobility, and connection that shape retirement satisfaction.

Weekly: Santa Rally in Holding Pattern

Stocks opened lower to start the shortened holiday week with tech shares under pressure. Markets then moved sideways, but came under pressure after minutes from the December Federal Reserve meeting were released.

What Should I Do When the Markets Crash?

Market downturns are uncomfortable, but they can create planning opportunities. Some of the most valuable planning moves invovle taxes, timing, and flexibility.

The 4 Key Factors That Shape Better Investment Choices

Learn how the Investment Decision Filter helps investors make informed choices by evaluating risk, return, cost, and taxes together. A simple way to avoid one dimensional decisions and improve long term outcomes.

Are Robo-Advisors Really Low Cost? The After-Tax Picture Tells More

Robo-advisors offer low fees, but taxes from trading and distributions can impact your true return. Learn why net cost should include both platform fees and after-tax results.

The Backdoor Roth: High-Income Households Shouldn’t Skip This

Learn why the overlooked Backdoor Roth should be considered a staple for high-income households. Understand its limits, spousal IRA options, and key rules.

Tax Planning with a Pension: Why Strategy Changes for FERS Retirees

Pension retirees face a higher tax floor in retirement than non-pension retirees. Learn how FERS and other pension households can plan for taxes through Social Security timing, RMD management, Roth strategies, taxable accounts, and early pre-retirement planning.