Which Retirement Income Style Are You?

Your Retirement income style determines how you will receive income for the rest of your life. This is by no means a small decision. It is important to establish a framework that supports your preferred income style before you retire.

Some people want the flexibility of market growth, and they accept the volatility that comes with it. Others prefer the security of guarantees, even if it means missing out on some returns. Many want a mix of both.

Researchers such as Dr. Wade Pfau and Jason Smith have shown that retirees tend to align with three primary philosophies when creating income: Total Return, Income Protection, and Risk Wrap. Understanding which approach speaks to you can bring structure and confidence to your plan.

Key Takeaways

- Your retirement income style defines how you’ll create income and manage risk throughout retirement.

- Total Return offers flexibility and long-term growth but requires discipline during market downturns.

- Income Protection prioritizes predictable income, even if it limits growth potential.

- Risk Wrap blends market participation with protection, offering growth potential with built-in guardrails.

- Asset Segmentation divides retirement savings into short, mid, and long-term “buckets.

- There’s no single “right” approach- your best strategy is the one that fits your comfort, goals, and lifestyle.

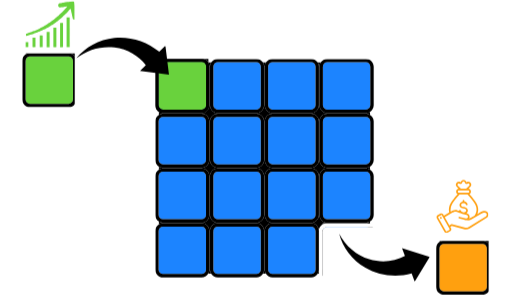

Total Return

The most commonly used approach by default. The Total Return strategy seeks to provide income from an investment portfolio using a sustainable withdrawal plan.

How it works:

Retirees draw periodic income (often 3–5% per year) based on portfolio performance.

The portfolio performance seeks to replenish up to or in abundance of what was taken out and used for income.

Flexibility for how much to take out in any year.

Long-term growth opportunity subject to market performance.

Income may fluctuate with markets, which requires discipline during downturns.

⚠︎ Caution:

Withdrawals during down markets act as a double negative and can permanently reduce future growth potential.

Key Considerations:

Investors comfortable with market cycles, value growth potential, and flexibility.

This approach often works well for those with ample assets and the temperament to stay invested during market volatility. People who have essentially ‘overfunded’ their retirement have the unique ability to take more risk than the average investor. Why? Because due to the size of their retirement nest egg, the market swings have little impact on their retirement income because their retirement income withdrawals are relatively small compared to the size of their nest egg.

Income Protection

This strategy focuses on creating a reliable "retirement paycheck" through predictable income sources such as pensions, annuities, and Social Security.

How it works:

The goal is to cover essential expenses with predictable income.

Assets are dedicated/used to purchase a reliable stream of lifetime income

Market growth opportunity is sacrificed in exchange for predictability

Remaining assets can then be invested for growth or legacy.

⚠︎ Caution:

The guaranteed income source may be sufficient now, but inflation may whittle away at its purchasing power in years to come.

Key Considerations:

Retirees who value stability and knowing their core income is secure. Not everybody’s goal is to make as much money as possible. At the end of the day money is a tool we use to purchase convenience, memories, experiences, etc. Retirement income planning is no different. Choosing a stable form of income and foregoing market growth is similar to choosing your money to serve an exclusive purpose- retirement income.

Risk Wrap

A hybrid approach that seeks a balance between market growth opportunity and a minimum income floor to cover necessary expenses.

How it works:

The portfolio participates in market gains but includes buffers or a small income pension to reduce downside risk.

Ideal for those who want growth participation- without full exposure to volatility- and some predictability.

Key Considerations:

Retirees who prefer a balanced path, looking for growth with some built-in guardrails. Taking the stance that we have the probability-based approach of Total Return on one side of the spectrum, and Income protection on the other end as our safety option, Risk Wrap lands in the middle. Arguably, as a hybrid option it bears the benefits and the drawbacks of both strategies.

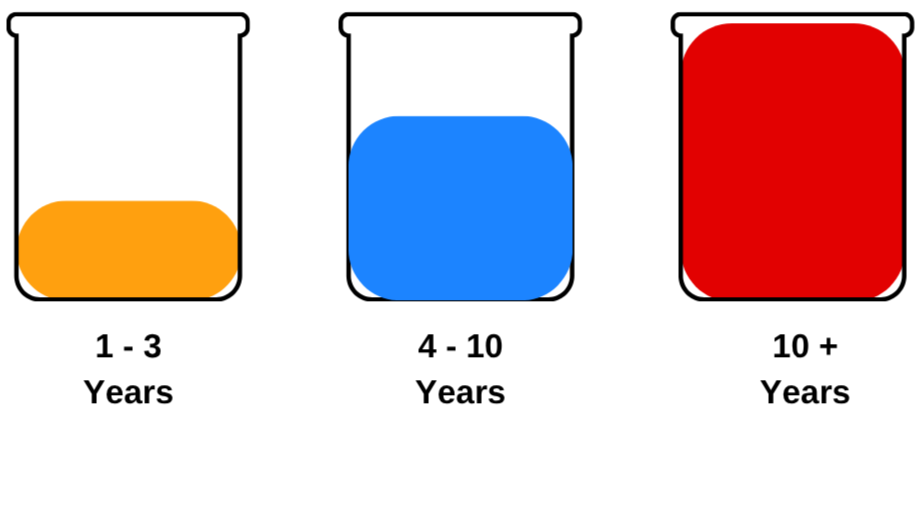

Asset Segmentation

Often called the bucket approach, divides retirement savings into separate “time-based” portfolios.

How it works:

Each bucket is set to fund different time periods of your retirement.

Short-term bucket: cash or conservative assets designed to fund near-term living expenses.

Intermediate bucket: moderate investments replenishing income for the next 5–10 years.

Long-term bucket: growth-oriented investments that combat inflation and support later-life or legacy goals.

Buckets are gradually refilled as time progresses, keeping spending aligned with market conditions.

⚠︎ Caution:

Without disciplined refilling, the structure can drift away from its intended design.

Key Considerations:

Retirees who prefer visual clarity and want to separate short-term security from long-term growth. It appeals to those who feel more confident when their near-term income needs are already covered.

This second hybrid approach can complement any of the other income styles, since it provides a framework for sequencing withdrawals. It helps retirees see that not all assets carry the same purpose or time horizon within a plan.

How to Discover your Income Style

Consider these reflection questions:

Do you value predictability or flexibility more?

Would you be comfortable if your income changed from year to year?

Do you view your investments primarily as a paycheck replacement or as a long-term growth engine?

Understanding your answers is the first step in designing a plan that aligns with your personal comfort and lifestyle goals.

There is no single "right" way to create retirement income, only the approach that best matches your preferences, priorities, and available resources.