Risk, Severity & Opportunity: Why Risk Is More Than One Idea

Most people look at risk as a single concept, usually tied to the fear of losing money. In reality, risk has two sides. Every financial decision carries the potential for negative outcomes and the potential for positive ones. These are not the same and they are not equal. The downside is severity and the upside is opportunity. Understanding this full range of outcomes leads to better decisions than focusing on volatility alone.

Key Takeaways

- Risk has two sides: severity (downside) and opportunity (upside)

- Severity reflects how damaging a negative outcome would be if it occurred..

- Opportunity reflects how meaningful the potential upside is for taking that same risk

- Time horizon influences how severity and opportunity show up in a plan

- People often misjudge risk by seeing only the probability, not the magnitude of each side

How people think of Risk

When people talk about risk, they usually mean “the chance that something bad happens.” It is a reasonable starting point, but it overlooks the full distribution of what can occur. Every financial decision has both negative and positive possibilities, and each side carries its own scale of impact. That balance matters far more than the word risk on its own.

Risk is the probability that an outcome happens. It does not describe the magnitude of that outcome. Two decisions can carry the same probability of loss yet have very different consequences. Likewise, the same risk can lead to very different upside results depending on the opportunity attached to it.

In short, people often react to short term discomfort rather than the full distribution of possible outcomes.

Risk, Severity, and Opportunity

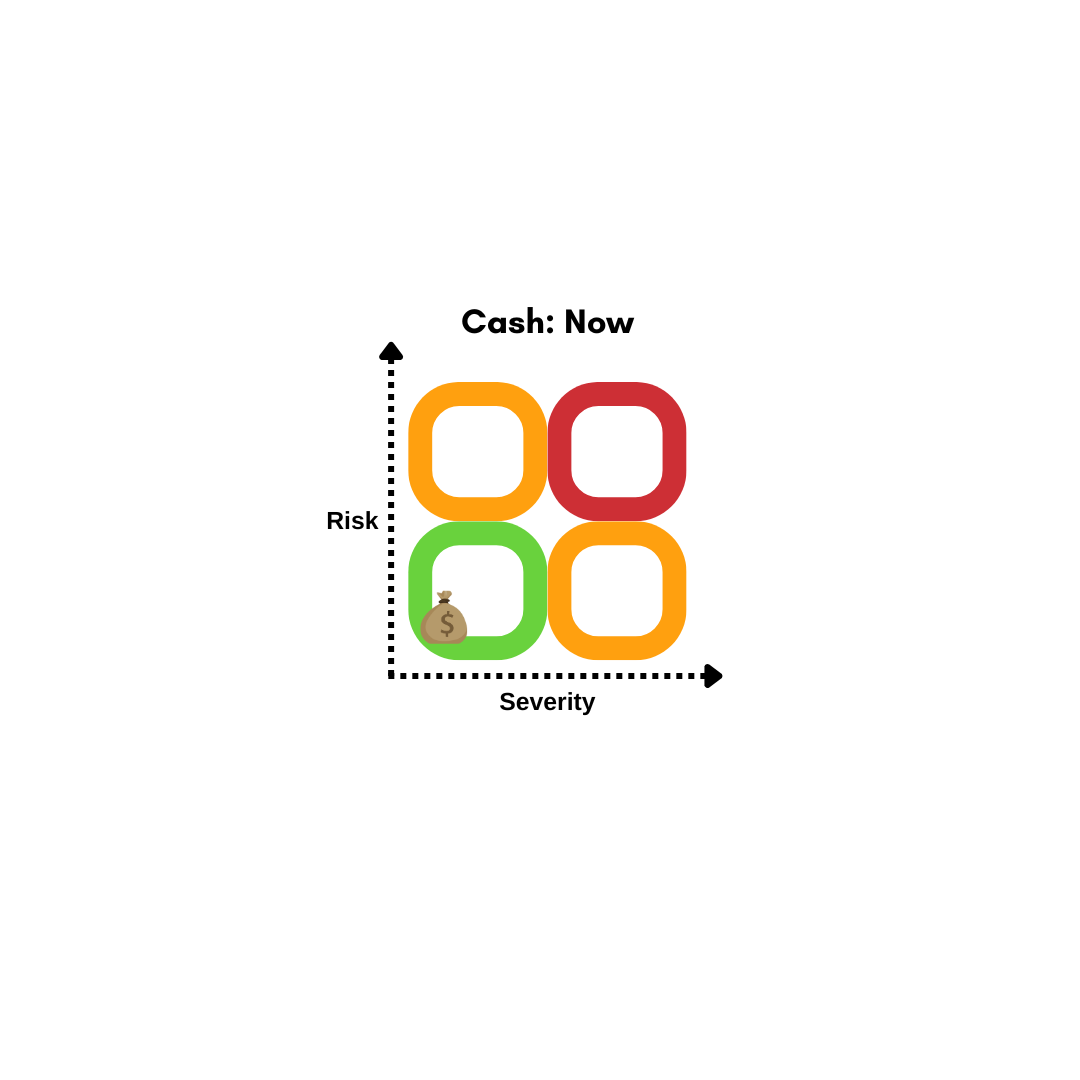

To see risk clearly, it is helpful to break it down into three separate components.

Risk: Probability -The chance that an outcome, positive or negative, occurs. It is the likelihood of movement, not the size of the result.

Severity: Downside Magnitude- Severity reflects how damaging the negative outcome would be if it happens. An event can carry a low probability but very high severity. In finance, severity shows up as the potential size of drawdowns, permanent losses, or outcomes that threaten long term financial security.

Opportunity: Upside Magnitude- Opportunity reflects the potential scale of positive outcomes for taking risk. Higher-risk assets often carry a wider range of possible returns. The upside is part of the distribution and deserves equal weight in the evaluation.

In statistical terms, the balance between severity and opportunity reflects the skewness of a distribution, which simply describes how tilted the potential outcomes are toward the upside or the downside.

Most investors see the risk and the severity, but they rarely see the opportunity. Yet all three exist simultaneously and influence one another.

Factors That Shape the Balance

The relationship between probability, downside, and upside shifts based on several inputs. Time horizon is one of the most influential because short term risk feels very different from long term risk.

Cash is a classic example.

Short term: low risk, low severity, low opportunity.

Long term: low risk, but severity increases due to inflation and opportunity remains limited.

Equities sit on the opposite end.

Short term: higher risk, meaningful severity, meaningful opportunity.

Long term: risk has historically decreased, the frequency of severe outcomes declines, and opportunity increases due to compounding.

Other factors shape the balance as well:

Liquidity needs

Income stability and cash flow

Required rate of return

Tax structure

Market environment

Personal tolerance and behavior

These inputs influence how attractive or dangerous each part of the distribution becomes.

What Happens If…

When making decisions, the question is not just “What is the risk?” It is “What happens if the downside occurs, and what happens if the upside occurs?”

A low-risk decision with very low opportunity may not support long term goals. A higher-risk decision with meaningful opportunity may be appropriate if the severity is manageable and the time horizon supports recovery.

Opportunity is not an afterthought or a consolation prize. It is the reason people invest.

A Framework for Better Decisions

Effective financial decision-making evaluates:

The probability of various outcomes

The scale of the downside

The scale of the upside

The time horizon required for each

The personal context that determines what is acceptable

When risk, severity, and opportunity are evaluated together, it becomes easier to make decisions that support long-term goals rather than reacting to short-lived events.