Risk & Severity: What Good Investors Understand

Every investor faces a range of possible outcomes whenever they make a financial decision. Risk tells us the probability of those outcomes. Severity tells us how damaging the negative ones would be if they occur. Strong investing requires understanding both. When investors misread severity, they often react to events that are uncomfortable instead of focusing on events that are truly harmful. Seeing the difference is one of the foundations of good long term behavior.

Key Takeaways

- Risk describes the probability of outcomes, both positive and negative

- Severity describes the magnitude of the negative outcome if it occurs

- Time horizon influences how exposed an investor is to severe outcomes

- Understanding severity leads to better behavior as an investor

What Severity Really Means for Investors

Severity measures how damaging negative outcome will be if it occurs. It has nothing to do with how often something happens. Instead, it reflects the size of the harm when it does.

Some non-investment examples of how Risk and Severity interact:

Traveling by Airplane- Flying is statistically the safest mode of transport. However, the severity of an accident is loss of life.

Risk: Low Severity: High

Cut off in Traffic- Ask anyone on the East Coast, and they will say they their city has the worst drivers. I am no different- Maryland Drivers are a unique animal. Getting cut off is a daily occurance. However, it does not lead to loss of life.

Risk: High Severity: Low

In statistical terms, severity relates to the downside skewness of possible outcomes, which describes how far the negative tail can stretch.

For investors, this means:

A frequent but shallow decline has low severity.

A rare but devastating loss has high severity, even if the probability is small.

Strong investing requires knowing which category you are dealing with.

High Severity Risks That Investors Commonly Overlook

When investors focus only on risk (probability), they often treat every downturn as equally dangerous. This leads to emotional decisions and poor long term behavior. In reality, most normal market declines have low severity, while several quieter, more subtle choices carry high severity if left unaddressed.

Below are the situations where severity matters most:

Being too concentrated in one position

A job stock, a single asset, or an undiversified holding may feel familiar or stable. But if it fails, the severity is enormous.

Few investors fully recover from a concentrated collapse.

Avoiding equities for extended periods

Holding too much cash or staying overly conservative feels safe in the short term, but the long term severity is high due to inflation and lost compounding.

Withdrawing during a downturn without a plan

Selling to generate income when markets are down locks in losses and increases the severity far beyond the decline itself.

Delaying savings during early accumulation years

Missing the early compounding window creates a permanent gap. The severity grows each year the start is delayed.

Skipping essential insurance or adequate liquidity

The probability of needing them may feel low, but the severity of not having them is often catastrophic.

Chasing investment trends

FOMO can lead to buying good stocks at a bad price. the euphoria of elevated gains can lead investors to want to join the party a little too late. This can place investors in a critical position.

Investors who focus on severity can identify these risks early and make better decisions to avoid them. Without this lens, the most damaging risks often go unnoticed.

How Time Horizon Changes Severity

Time horizon does not change what severity is, but it changes how exposed an investor is to severe outcomes.

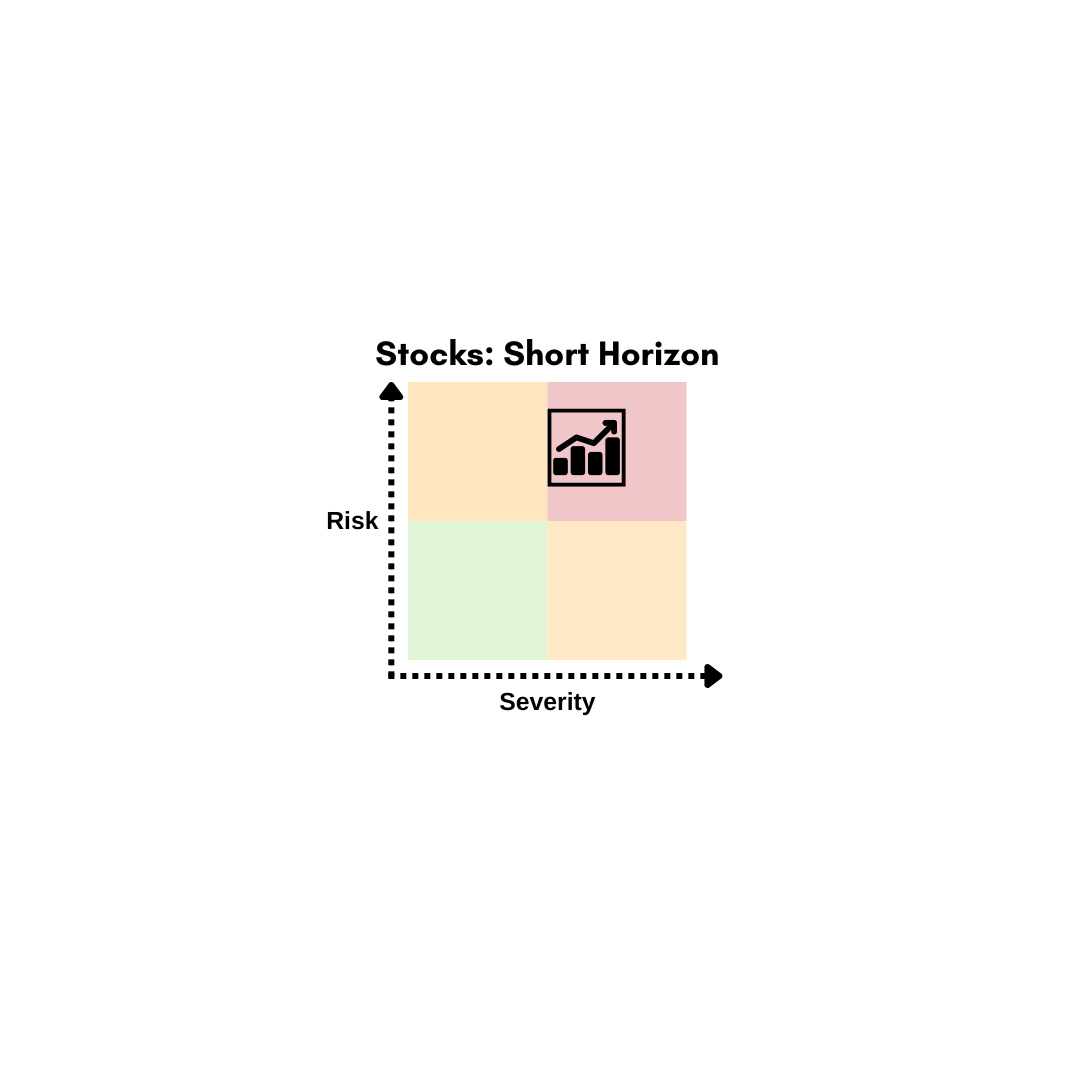

Short Horizons Increase Severity

Investors who need to withdraw soon are more sensitive to downturns. A decline that is recoverable over ten years may be severe over two.

Long Horizons Reduce the Severity of Normal Volatility

For long term investors, most market swings carry low severity because there is time to recover.

Long Horizons Increase the Severity of Inflation and Missed Growth

The longer the horizon, the more damaging it becomes to stay in cash, invest too conservatively, or miss compounding.

Investors improve behavior when they align decisions with the correct horizon.

Using Severity to Become a Better Investor

Severity is one of the most powerful tools for improving investment behavior because it encourages investors to focus on what truly threatens their plan instead of what feels uncomfortable.

A strong investment process evaluates:

Risk: the probability of outcomes

Severity: the magnitude of negative outcomes

With these two elements working together, investors can:

Stay invested during normal market declines because the severity is low.

Diversify concentrated positions because the severity of being wrong is high.

Prioritize inflation protection because the severity of erosion grows over time.

Avoid market timing because the severity of being wrong outweighs the likelihood of being right.

Maintain insurance and cash reserves because the severity of not having them is high.

Severity acts as a filter. It directs attention to risks that truly matter for long-term success.

What’s Next?

Investment Opportunity through Risk: The Price we Pay

How the magnitude of positive outcomes supports long term growth and why opportunity is the other essential component of smart financial decision making.