Are AI Stocks in a Bubble?

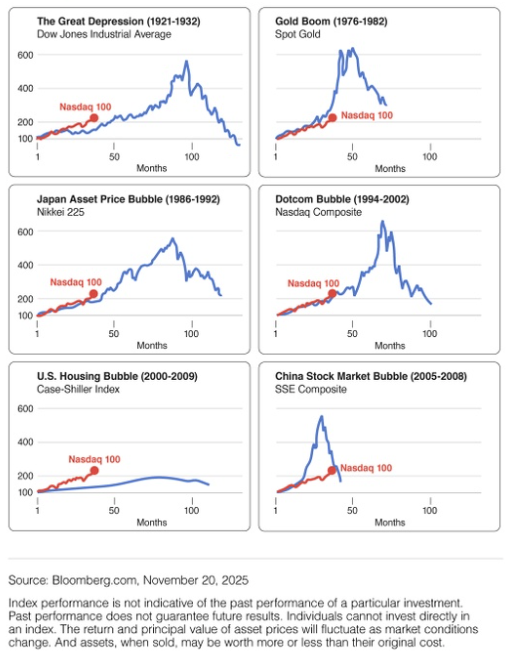

Lately, charts comparing the AI-driven market rally to past bubbles have been making the rounds. Many of them overlay the Nasdaq 100 from 2022 to 2025 year-end against historic manias.

At first glance, the similarities can feel unsettling. The implication is clear: this looks like a bubble, so a crash must be coming. But these comparisons deserve a closer look. What they show is only part of the story, and what they leave out matters just as much.

Key Takeaways

Bubble charts often rely on visual pattern matching rather than fundamentals

Similar price patterns appear frequently in normal market cycles

Trying to time markets based on bubble fears can introduce new risks

Long-term investment decisions should stay anchored to goals and time horizon

What These Bubble Charts Are Really Showing

Most bubble charts reset to start at the same point, which makes different market periods look alike. When you normalize data this way, many investments will show similar upward patterns at some point in their history.

That does not mean they were bubbles. It often reflects normal cycles driven by innovation, earnings growth, or changing economic conditions. Visual similarity alone cannot determine whether prices are unsupported by fundamentals.

Could parts of the market be stretched today? Possibly. But these comparisons, by themselves, cannot answer that question.

Why Timing Bubble Fears Is Difficult

Even if valuations feel elevated, two challenges remain. First, it is extremely difficult to identify a bubble in real time. Second, no one knows when a correction might occur.

In 2025, tariff concerns pushed the S&P 500 sharply lower before markets rebounded and moved to new highs within months. Investors who exited due to fear faced the difficult task of deciding when to reenter.

Most Market Crashes Are Not the Ones Everyone Is Watching

Many major market declines are triggered by events that were not widely anticipated. They tend to come from surprises rather than risks that dominate headlines. When a concern is openly debated, markets often begin adjusting before anything actually happens. Prices reflect disagreement, not surprise. The largest disruptions tend to occur when something breaks that few were focused on.

The 2008 financial crisis is a clear example. In the years leading up to it, investors were watching inflation, interest rates, and economic growth. What was not fully understood was how deeply mortgage risk had spread through the financial system. By the time that risk became clear, markets had already moved.

Staying Focused on the Long Term

Market narratives will always change. Today it may be AI. Tomorrow it may be something else.

A sound investment approach stays anchored to your goals, timeline, and risk tolerance rather than short-term headlines. Markets will move for many reasons. What matters is maintaining a strategy designed to navigate those movements over time.

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Bethesda Wealth Planning Group