Weekly: Stocks Extend Early-Year Momentum

Stocks posted solid gains in an eventful first full week of the new year. Investors navigated a mix of economic data, geopolitical headlines, and shifting sector leadership, while optimism around growth and artificial intelligence continued to influence market sentiment.

Key Takeaways

Major U.S. stock indexes finished the week higher, led by the Dow Jones Industrial Average

Technology and AI-related stocks helped push indexes to new highs midweek

Sector rotation emerged later in the week as investors moved toward cyclical and defense stocks

The December jobs report supported expectations that the Federal Reserve may maintain flexibility on interest rates

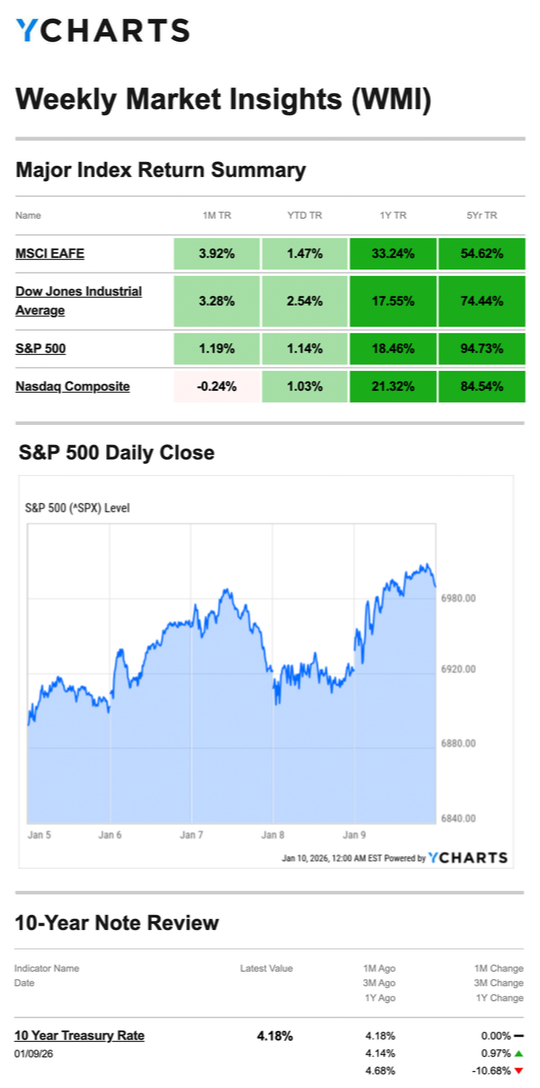

YCharts.com, January 10, 2026. Weekly performance is measured from Monday, January 5, to Friday, January 9. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Market Performance Snapshot

For the week, the Standard & Poor’s 500 Index gained 1.57%. while the Nasdaq Composite added 1.88%. The Dow Jones Industrial Average rose 2.32%, marking its strongest relative performance among the major indexes. Developed international markets also advanced, with the MSCI EAFE Index up 1.41%.

These gains came amid steady participation across sectors and continued enthusiasm around select areas of the market, particularly technology earlier in the week.

A Santa Rally for the Dow

Stocks opened the week higher on Monday, led by the Dow Industrials, as investors looked past geopolitical developments and focused on broader economic conditions. By the close of trading, the Dow had advanced enough to officially qualify for the traditional Santa Claus Rally period, which spans the final five trading days of the year and the first two of the new year.

While the Dow achieved that milestone, the S&P 500 and Nasdaq finished just short of meeting the same definition.

AI Momentum and Record Highs

Midweek trading saw renewed strength in technology stocks, particularly among chip manufacturers tied to artificial intelligence themes. This momentum helped push the Dow Jones Industrial Average above the 49,000 level for the first time, while both the Dow and the S&P 500 recorded new record closing levels and intraday highs.

As the week progressed, market leadership broadened. Investors appeared to rotate out of some technology names and into cyclical sectors. Defense stocks also received a boost following discussions around increased defense spending targets in future federal budgets.

Jobs Report and Interest Rate Expectations

Friday’s December employment report showed job growth that was slower than economists expected, with 50,000 jobs added and the unemployment rate edging down to 4.4%. While the headline numbers were softer, markets responded positively.

Investors interpreted the data as supportive of a Federal Reserve that may have room to be patient with interest rate decisions at its upcoming January meeting. Over the past year, job growth has slowed materially, reflecting both economic cooling and a meaningful reduction in federal employment.

This Week: Key Economic Data and Events

Monday: Fed Presidents Tom Barkin (Richmond), Raphael Bostic (Atlanta), and John Williams (New York) speak.

Tuesday: Consumer Price Index (CPI), New Home Sales* (Oct.), Fed Presidents Alberto Musalem (St. Louis) and Tom Barkin (Richmond) speak, Federal Budget Deficit update.

Wednesday: Retail Sales* update (Nov.), Producer Price Index (PPI)* (Nov.).

Thursday: Weekly Jobless Claims, Import Prices* (Nov.), Fed Governor Michael Barr and Fed Presidents Jeff Schmid (Kansas City) and Tom Barkin (Richmond) speak

Friday: Industrial Production, Fed Vice Chair Philip Jefferson and Fed President Tom Barkin (Richmond) speak

* indicates publication of a report delayed by the government shutdown in October and November.

This Week: Companies Reporting Earnings

Tuesday

JPMorgan Chase & Co. (JPM)

The Bank of New York Mellon Corporation (BK)

Delta Air Lines, Inc. (DAL)

Wednesday

Bank of America Corporation (BAC)

Wells Fargo & Company (WFC)

Citigroup Inc. (C)

Thursday

Morgan Stanley (MS)

The Goldman Sachs Group, Inc. (GS)

BlackRock (BLK)

Infosys (INFY)

Friday

The PNC Financial Services Group, Inc. (PNC)

Practicing Gratitude

Psychologists have defined gratitude as a positive emotional response to receiving a benefit from someone or something. In positive psychology, gratitude is the human way of acknowledging the good things in life. Thankfully, you can learn gratitude if it does not come innately.

Practicing gratitude offers numerous benefits, particularly during times of stress and uncertainty. Gratitude invites positive emotions that can have physical benefits through the immune or endocrine systems. Research shows that when we reflect on what we appreciate, the parasympathetic or calming part of the nervous system is triggered, which can have protective benefits for the body—including decreasing levels of the stress hormone cortisol and increasing oxytocin, the hormone involved in relationships that fosters feelings of well-being.

There are a few great ways to get started today and practice gratitude in your own life:

Write thank you notes

Keep a gratitude journal

Follow up with family and friends

Give back to your family, friends, and community

Pay kindnesses forward

Footnotes And Sources

1. WSJ.com, January 9, 2026

2. Investing.com, January 9, 2026

3. CNBC.com, January 5, 2026

4. CNBC.com, January 6, 2026

5. CNBC.com, January 7, 2026

6. WSJ.com, January 8, 2026

7. CNBC.com, January 9, 2026

8. IRS.gov, August 18, 2025

9. Mindful.org, August 25, 2025

Zacks, January 9, 2025. Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your goals, time horizon, and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule their earnings reports without notice.

Investors Business Daily - Econoday economic calendar; January 9, 2025. The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to provide accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts are also subject to revision.

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Bethesda Wealth Planning Group