FEGLI Option B: Why Many Federal Employees Pay More Than They Expect

Most federal employees enroll in life insurance early in their careers and never revisit it. That works fine until it doesn’t. The Federal Employees’ Group Life Insurance (FEGLI) program is simple on the surface, but one component in particular can quietly become expensive as you age. A short review can often uncover meaningful savings.

Key Takeaways

FEGLI has four parts, but Option B usually drives the largest premiums

Option B premiums increase automatically every five years based on age

Many employees carry more coverage than they still need as retirement approaches

Basic FEGLI often remains attractive in retirement due to the 75 percent reduction option

Understanding the Four Parts of Federal Employees’ Group Life Insurance

FEGLI coverage is divided into four components:

Basic: coverage is roughly your salary rounded up to the next $1,000, plus $2,000. Employees under age 45 also receive an extra benefit* that temporarily boosts this amount.

Option A: Flat $10,000 policy.

Option C: Coverage for a spouse and eligible children, elected in multiples.

Option B: Allows you to elect one to five times your salary

Basic, Option A, and Option C are usually modest. Option B is where costs can escalate.

*The “extra benefit” under FEGLI Basic: doubles your Basic coverage if you are age 35 or younger, then phases out between ages 36 and 45.

Why Option B Premiums Rise So Quickly

Option B pricing depends on two things: how much you earn and how old you are. Premiums are grouped into five-year age bands. When you cross into a new band at 50, 55, 60, and beyond, the cost increases automatically.

Early on, Option B can look inexpensive. Later, the same coverage can double or more every five years. Many employees do not notice until the higher deduction shows up on their paystub. By the time someone reaches their 60s, Option B can cost hundreds of dollars per month for coverage that once felt affordable.

What Should You Do Next?

If FEGLI costs are starting to feel unclear or uncomfortable, the goal is not to guess. It is to compare your current coverage against what you actually need and what it will cost going forward. A simple step-by-step review usually brings clarity quickly.

1. Review your paystub

Start with your Leave and Earnings Statement (LES) so you know exactly what you currently have. Confirm whether you carry Basic, Option A, Option B, and Option C, and note the multiples on Option B. Many employees are surprised by how much coverage they elected years ago and never revisited.

2. Estimate your actual life insurance need

Next, complete a basic life insurance needs estimator. This helps quantify the financial gap life insurance is meant to cover.

Life insurance is meant to protect against a financial gap. As retirement nears, that gap often shrinks.

Growing Thrift Savings Plan balances, paid-off homes, and independent children all change the picture.

Some retirees reach a point where their assets can support their family without a life insurance payout. Others still need coverage, but not at the levels they carried mid-career. This is where Option B often deserves a review.

3. Project your future FEGLI costs

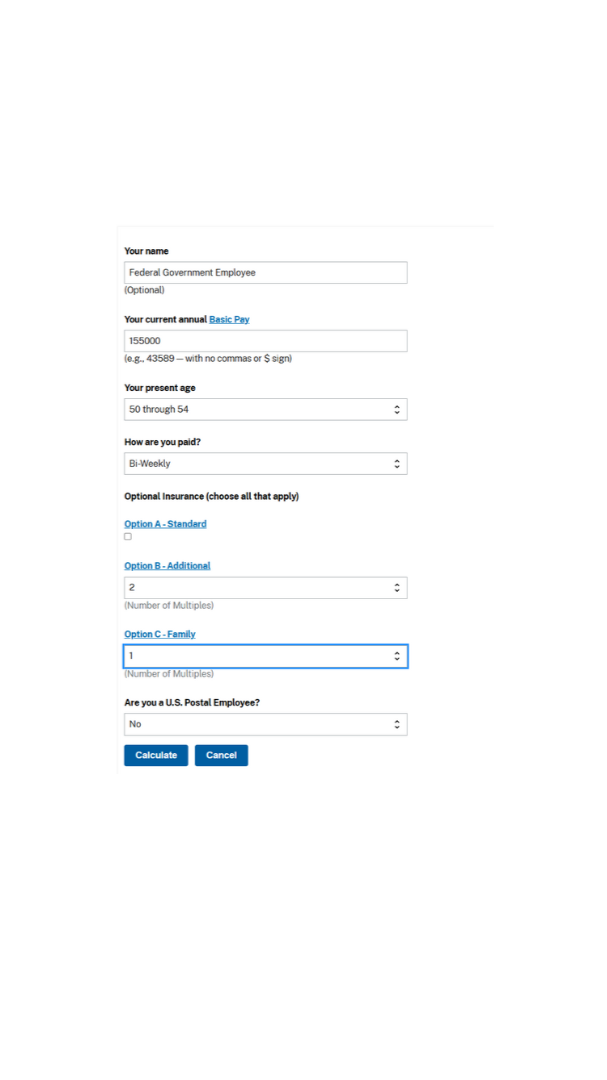

Once you know what you have today, use the Office of Personnel Management (OPM) FEGLI calculator to see how your premiums change at future age brackets. Option B costs are not static, and reviewing how premiums rise at 50, 55, 60, and beyond often reframes the decision.

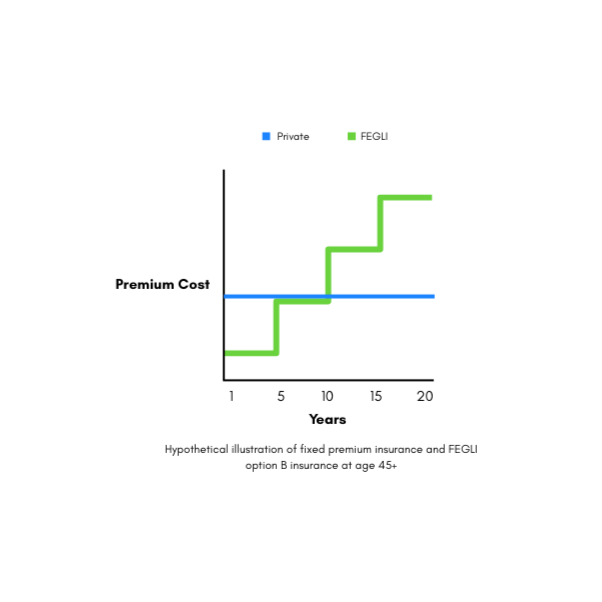

4. Compare against private insurance options

Finally, compare those projected FEGLI costs to what similar coverage might look like in the private market. Private policies often use level premiums that stay the same for the life of the policy. They may start more expensive than FEGLI Option B, but unlike FEGLI, the price does not reset higher every five years. A side-by-side comparison helps determine the lifetime cost of each option.

Working through these steps turns FEGLI from a background deduction into a deliberate decision and helps ensure your insurance aligns with where you are today rather than where you were twenty years ago.

Why Basic FEGLI Often Stays in Retirement

Basic FEGLI includes a feature many retirees keep: the 75% reduction. If you carry Basic coverage for the required period before retirement*, you can continue it afterward.

Premiums remain the same until age 65, then stop entirely. After that, coverage gradually reduces to 25% of its original amount. While the benefit shrinks, the remaining coverage is free for life. For many retirees, this is a reasonable trade-off.

*You must have been continuously enrolled in Basic for the five years of service immediately before retirement or for your entire period of eligibility if less than five years.

Final Thoughts

FEGLI benefits are a helpful tool when used intentionally. For many federal employees, it provides accessible life insurance coverage and an easy way to establish protection early in a career.

Over time, however, circumstances change. Families grow, assets accumulate, and retirement comes into focus. Coverage that once addressed a clear financial gap may no longer be structured in the most efficient way.

Reviewing your benefits periodically helps ensure they are still serving you and your family’s needs. When FEGLI elections align with your current situation, they tend to feel less like a routine payroll deduction and more like a benefit that continues to support your long-term plan.