Simeon Esprit: An Interview on Financial Planning and Leading with Intention

Financial planning is rarely just about numbers. It is shaped by experiences, habits, and the way we see the world.

In this interview, Simeon Esprit shares the thinking behind his approach to financial planning, from the lessons learned early in life to the principles he uses to help families navigate major transitions. It’s a conversation about direction, consistency, and what it really means to build wealth over time.

Q: How do you describe the work you do as a Financial Planner?

I help people turn financial complexity into clear, actionable plans. Most of my work centers on families approaching retirement who want more than projections on a page. They want direction. They want tradeoffs explained honestly. And they want a plan they can actually follow in real life. My approach is heavily inspired by Patrick Lencioni’s book on consulting, ‘Getting Naked’.

Provide good and considerate advice as soon as possible. Begin the work ASAP and start solving problems as if they were already your client. This approach encourages a selflessness in how I engage with families.

Q: Where did your relationship with money begin?

I didn’t grow up with a financial safety net. I was born in London, England, and learned early that good money habits were not optional. They were a necessity. Throughout my teenage years and college education, I worked multiple jobs, saved diligently, and budgeted carefully because there was no backstop.

What began as survival eventually became intuition, and that intuition was later sharpened through formal education and professional experience.

Q: What led you to financial planning specifically?

Once I realized that the habits and frameworks I had developed out of necessity were far less common than I assumed, I gravitated toward a service-based role in finance. I had spent years working in service industries, from hospitality to bartending, and I wanted a career that combined analytical skill with human understanding.

Financial planning lives at the intersection of numbers and real life. Knowing the math matters, but knowing the person matters just as much.

Q: How do you think about building wealth?

I believe wealth is built through habits, structure, and consistency. If you get caught up in trying to catch lightning- chasing the perfect investment- you’ll likely find yourself making little to no progress. The internet tends to reward flashy ideas and bold predictions, but in practice, progress comes from repeatable systems and thoughtful prioritization.

My role as a Planner is not to manufacture outcomes. It is to design frameworks that people can rely on through different market environments and life transitions. This creates a ripple effect across people’s lives that compounds over time.

Q: Who do you typically work best with?

Most of my clients are well into their careers and standing on the edge of change. Retirement is approaching, income sources are shifting, and the margin for error feels smaller. They tend to be pragmatic and understand that every decision has pros and cons, that risk never disappears, and that good planning is about managing tradeoffs rather than eliminating uncertainty.

They’re looking for a consultant and confidant who can help them move forward with confidence.

🔥Fast Round🔥

One habit that’s had the biggest positive impact on your life?

“Master the mundane.” Focusing on consistency rather than intensity has shaped how I approach both life and financial planning.

Favorite workout or sport?

Calisthenics. I’ve tried many training styles, but building strength around capability is something I’ll always keep in my routine.

What’s something you’re currently trying to get better at?

Respecting my peace. I’m learning to distinguish between things that are difficult in the short term but support long-term peace, and things that quietly erode it.

If you weren’t a financial planner, what do you think you’d be doing?

Developing apps. I enjoy creative outlets and have hundreds of ideas, from games to practical tools people could use day-to-day.

One piece of advice you’d give your younger self?

“The only person who needs to be proud of the day you’ve had is you”

Q: What do clients usually experience when working with you?

Clients often describe me as patient, steady, and deeply attentive. I take the time to understand both the financial details and the personal context behind them. Meetings are designed to reduce tension because the goal is relief and momentum. When clients leave a conversation with me, they should feel lighter, more focused, and energized by the progress ahead. Direction matters more than precision. Forward motion beats perfect forecasts, which I believe to be a false sense of certainty.

Q: Are you the right fit for everyone?

No, and I’m comfortable with that. I don’t help people chase overnight wins or validate pre-decided ideas. My work is best suited for those who want thoughtful guidance, accountability, and a plan grounded in reality rather than speculation.

Q: What influences your thinking outside of financial planning?

Outside of work, I’m a lifelong athlete and recently took up boxing. I’m drawn to the idea that fitness should build capability and function over appearance. I also enjoy writing fiction, which mirrors how I think about planning.

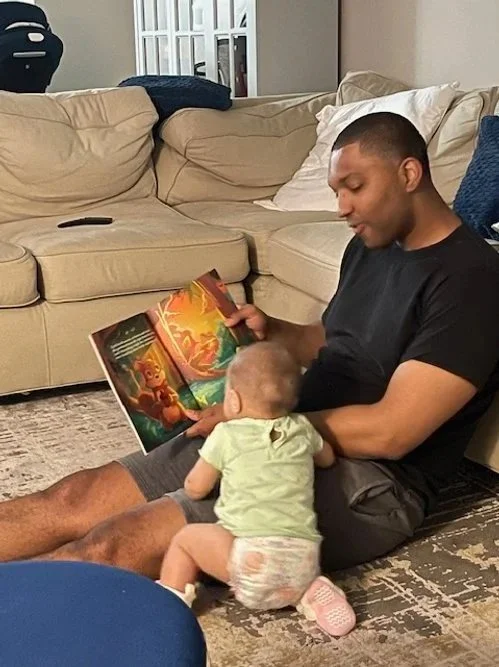

In fact, I published a children’s book as my wife and I were waiting for our first child to be born in 2024.

Every financial plan is a puzzle. Each client starts with different pieces, different gaps, and a different picture of what “enough” looks like. The challenge isn’t forcing a template, but assembling something that fits.

Q: How has your personal life shaped your perspective on planning?

I attended the University of Pennsylvania, where I met my wife. We recently welcomed our first child, and becoming a father has reinforced my focus on long-term thinking and planning with intention.

I often encourage retirees to pursue their own interests and creative outlets. A fulfilling retirement requires purpose, structure, and engagement beyond the balance sheet.