Should I Invest Lump Sums Differently Than Ongoing Contributions?

Most investors treat all new money the same.

Whether it comes in as a monthly contribution or a large lump sum, it often gets invested using the same rules and assumptions. That approach feels consistent, but it quietly overlooks something important.

Not all investment strategies want to be entered the same way.

Disclaimer: This is for educational purposes only and should not be considered advice. Every person’s situation is different and requires diligence when planning for retirement. Please consult with a financial professional or a tax professional before making changes to your investments.

Key Takeaways

- Lump sum investing has historically produced higher returns more often than dollar-cost averaging

- Phasing money in over time can improve comfort and discipline, even if it does not maximize expected return

- Broad diversified investments behave differently than concentrated or contrarian ideas

- Behavior, time horizon, and taxes can matter more than the math

Not All Investments Want the Same Entry

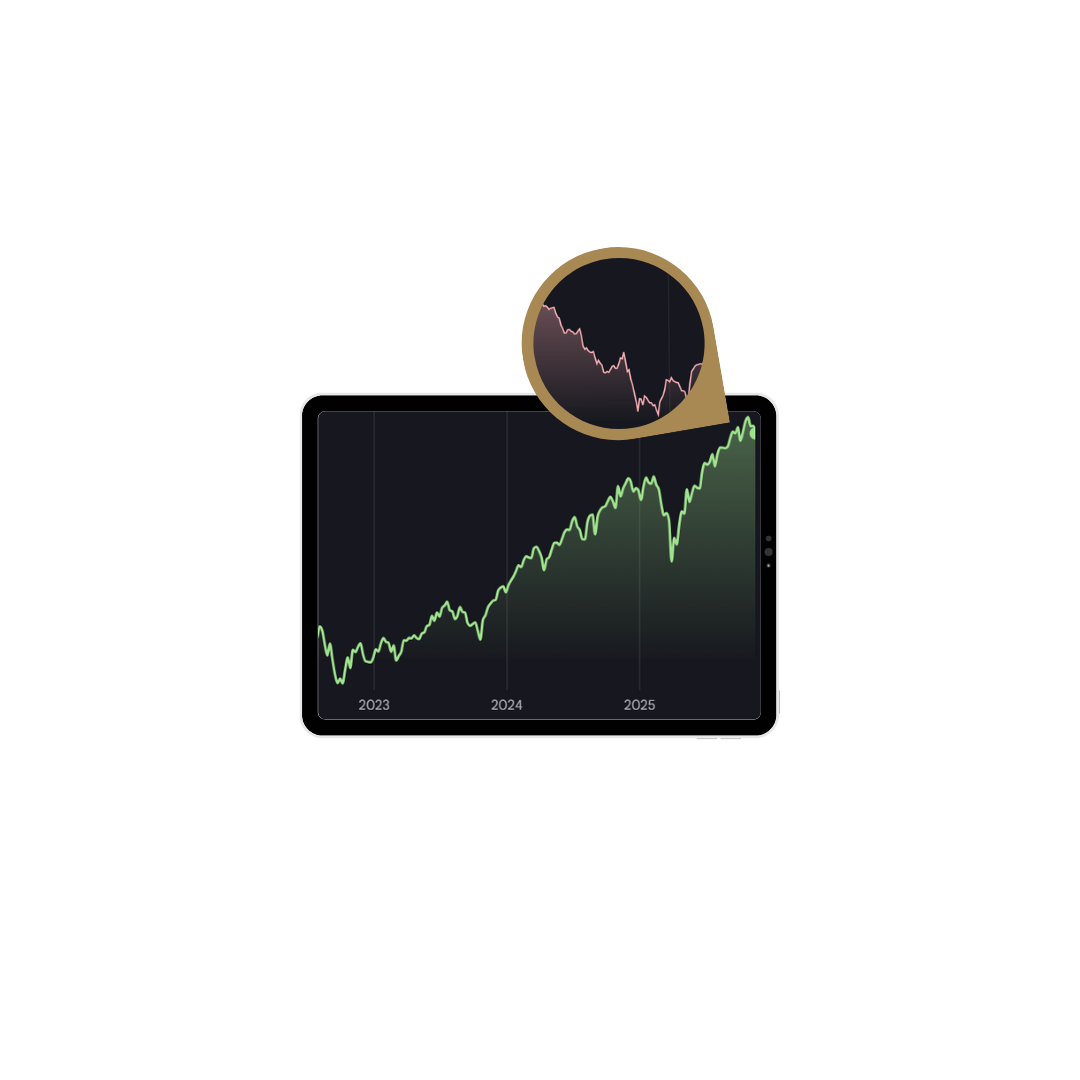

Most research comparing lump sum investing and dollar-cost averaging (DCA) looks at broad, diversified portfolios. That is an important detail. Broad market and diversified value or growth strategies tend to rise over time, even when the path is uneven. For these types of investments, earlier exposure has historically been rewarded, which is why lump-sum investing has often produced higher ending values.

But not all investments behave like the overall market. Some strategies are narrower, more volatile, or explicitly contrarian. Think undervalued sectors, cyclical industries, or areas of the market that have fallen out of favor. Healthcare is a good example of a sector that’s lagged and “fallen out of favor” relative to the broad market and is now beginning to see a surge.

These ideas can remain cheap for long periods. They can also get cheaper before they recover. In those cases, the way you enter matters more. A tranche-based entry can help manage timing risk and take advantage of continued weakness rather than committing all capital at once.

The more concentrated the idea, the more important the entry path becomes.

Does the Allocation Change?

For long-term goals like retirement, the target allocation is usually driven by time horizon, risk capacity, and liquidity needs. If those inputs do not change, the allocation often should not change either. A retirement portfolio designed around a specific mix of stocks and bonds does not suddenly need to be redesigned because the money arrived all at once.

What often changes is the implementation.

A lump sum might be invested immediately.

Or it may be phased in over a defined period.

Ongoing contributions naturally average in as new cash arrives.

This is less about changing the plan and more about managing how it gets put to work.

Where DCA Fits In

Dollar-cost averaging is often misunderstood. It is not designed to maximize return. Its role is to reduce short-term regret and make market swings easier to live with. Historical comparisons between lump sum investing and DCA into diversified portfolios show that lump sums have produced higher returns more often than not. Markets have risen more frequently than they have fallen, which explains the math.

But the experience matters too.

Many investors are more comfortable easing into risk, especially when a large sum is involved. That comfort can make the difference between sticking with a plan and abandoning it at the wrong time.

A Simple Way to Think About It

A simple way to think about this is to match the funding approach to the nature of the investment.

Broad market or diversified value or growth exposure

Time horizon: long, often 10 to 20 years or more

Evidence: lump sum has historically outperformed DCA more often than not

Implementation: lump sum or a short ramp-in period if behavior is a concern

Concentrated or “undervalued” sectors

Characteristics: high volatility, uncertain timing, extended drawdowns possible

Implementation: periodic entry often fits better

Single-stock or narrow thematic ideas

Characteristics: high idiosyncratic risk and timing sensitivity

Implementation: smaller allocations with clear phasing rules rather than one large purchase