What a Bad Retirement Often Looks Like

Sometimes the clearest way forward is to look in the opposite direction. A premortem study for retirement instead of asking, “What do I want my retirement to look like?” can help identify what we really want.

What would a bad retirement look like?

For many people, it is easier to spot what they want to avoid than to define the perfect vision upfront.

Key Takeaways

Unhappy retirements tend to fail in predictable ways

Lack of structure is often more damaging than lack of income

Social isolation increases once work ends unless addressed intentionally

Money stress is usually driven by uncertainty rather than account size

The most fulfilling retirements are built with intention

Common Habits That Lead to Unhappy Retirements

Studying unhappy retirements shows that problems rarely appear overnight. They usually develop slowly, often from decisions that seem reasonable at the time.

Losing Structure and Purpose- While working, most people have structure built into their lives. Work provides a schedule, expectations, and a sense of productivity. When retirement begins, that structure disappears immediately. Unhappy retirees often underestimate how important this structure was. Without replacing it intentionally, days lose definition and motivation fades.

Declining Social Interaction- Social connection also changes significantly in retirement. Work creates daily interaction, even for people who would not describe themselves as highly social. Once work ends, maintaining friendships requires effort. New relationships must be built deliberately. Unhappy retirees often assume it will happen naturally.

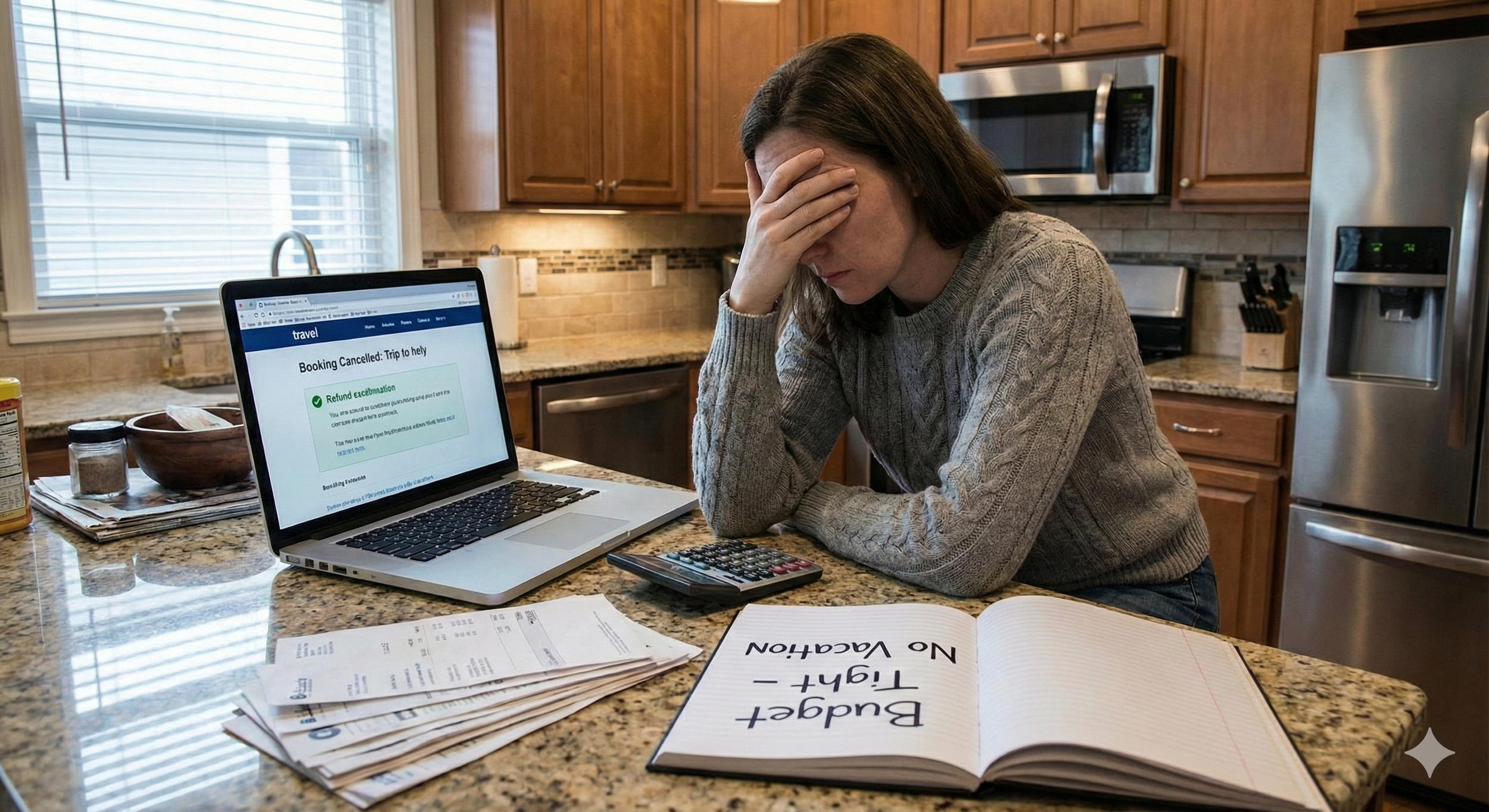

Ongoing Money Anxiety- Many unhappy retirees worry constantly about money, even when they have accumulated meaningful assets. This stress typically comes from uncertainty. Without a clear understanding of spending limits, income sources, and tradeoffs, every financial decision feels risky. That uncertainty can overshadow the benefits retirement was supposed to provide.

Giving Beyond What Is Sustainable- Helping children or grandchildren financially is common and often emotionally driven. Problems arise when generosity exceeds what a retirement plan can comfortably support.

Repeated financial assistance can quietly increase stress and reduce confidence, especially when retirees feel unable to say “no”. Without boundaries, even well-intentioned help can destabilize retirement.

Habits Common Among Happier Retirees

The most fulfilled retirees tend to avoid these pitfalls and replace them with intentional choices.

Staying Physically & Mentally Active- Happy retirees make staying active a priority. Physical movement supports energy, while mental engagement supports clarity and confidence. These habits reinforce each other and make it easier to stay involved in other areas of life.

Having Something to Work On- Fulfilled retirees have something that gives their time direction. This might be a hobby, volunteer work, a small business, mentoring, or family involvement.

The specific activity matters less than the fact that it exists. Having something to work on provides purpose and structure that work once supplied.

Continuing to Seek New Experiences- Learning and novelty play a meaningful role in long-term fulfillment. Travel, new skills, and new routines help retirees stay engaged and adaptable. Retirees who continue learning tend to maintain a stronger sense of momentum.

Step out of your comfortzone: Think back to a hobby you paused because work got too busy. Maybe there was an activity that you felt was outside the box, so you passed on it. Is there a topic you would have loved to study in school that you can now dedicate some time to without the pressure of being graded?

Final Thoughts

Every retirement is different, but unhappy retirees tend to struggle in similar ways. Happy retirements also share common traits.

A premortem study of your retirement can help you determine what you truly value.

By identifying the habits and decisions that often lead to dissatisfaction, it becomes easier to plan with intention and avoid common mistakes. Retirement planning is not just about accumulating assets. It is about designing a life that remains engaging, connected, and sustainable over time.