2026 Market Forecasts: A Moving Target

When you see the word forecast, it should be closely followed by a reminder: forecasts are built on assumptions, and assumptions change.

That lesson played out clearly in 2025.

After April 2, 2025, when new tariffs were introduced on what became known as Liberation Day, many market commentators reduced their full-year outlook for U.S. stocks. A few months later, those same outlooks were revised again as prices moved higher. The direction did not change because the future became clearer. It changed because the assumptions did.

Key Takeaways

Market forecasts are based on assumptions, not certainties

Outlooks often change as economic, political, and market conditions evolve

Short-term revisions are common, even within the same calendar year

A narrow forecast range does not mean a smooth investment experience

Why Forecasts Change So Often

Forecasts are snapshots, not promises. They reflect what analysts believe could happen given current information. When new information enters the picture, those views are updated.

Economic data, interest rate expectations, political developments, and regulatory shifts can all alter assumptions quickly. As a result, even well-researched forecasts can look outdated within months.

This is not a flaw in forecasting. It is a reminder of its limitations.

What Forecast Tables Do & Do Not Show

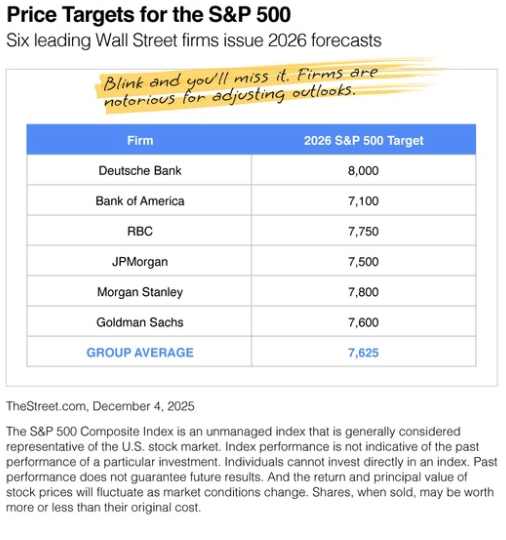

Forecast tables often show a range of expected outcomes for the year ahead. If you remove the highest and lowest projections, the remaining estimates typically cluster into a relatively tight band.

What these tables do not show is the path taken to get there.

Markets rarely move in straight lines. There will be periods when stocks feel unstoppable and periods when confidence fades quickly. Both can occur within the same year, sometimes within the same quarter!

Preparing for the Year Ahead

A forecast can be a helpful reference point, but it should not be mistaken for a plan.

Planning accounts for uncertainty. It assumes that markets will experience both advances and pullbacks, and that emotions tend to run high during both. Preparation is less about predicting exact outcomes and more about understanding how different scenarios could affect your strategy.

As we move into 2026, a useful mindset is to ‘be prepared’ and to know that ‘there is risk in every action.’ Whether you put money under your mattress or in the market, there is risk.