Weekly: Markets React to Data and Policy News

Stocks ended last week with modest losses after a volatile stretch driven by economic data releases, geopolitical headlines, and renewed tension around Federal Reserve leadership. While U.S. markets struggled to find direction, international stocks showed relative strength.

Key Takeaways

U.S. stock indexes finished modestly lower after a volatile trading week

Developed international stocks outperformed U.S. markets

Policy headlines and inflation data drove short-term market swings

Late-week gains helped recoup much of the earlier weakness

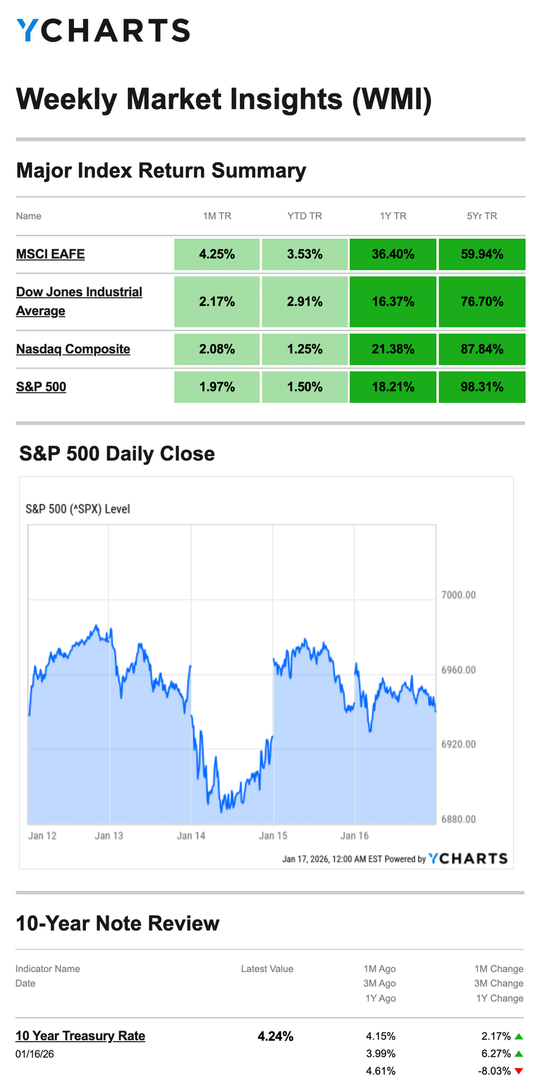

YCharts.com, January 17, 2026. Weekly performance is measured from Monday, January 12, to Friday, January 16. TR = total return for the index, which includes any dividends as well as any other cash distributions during the period. Treasury note yield is expressed in basis points.

Market Performance Snapshot

The S&P 500 Index declined 0.38% for the week, while the Nasdaq Composite fell 0.66%. The Dow Jones Industrial Average edged lower by 0.29%. In contrast, developed international stocks advanced, with the MSCI EAFE Index rising 1.41%.

Market performance reflected sharp day-to-day swings as investors reacted to a fast-moving news cycle rather than a single dominant theme.

Volatility Fueled by Headlines

Markets opened the week under pressure following reports that the Justice Department had launched a criminal investigation involving the Federal Reserve Chair. That news weighed on investor confidence early, though a coordinated statement from central bankers worldwide helped stabilize markets by Tuesday.

Additional policy headlines added to the uncertainty. A proposal from the White House to cap credit card interest rates for one year pressured financial stocks, while inflation data offered a mixed but generally reassuring signal. Headline inflation met expectations, and core inflation came in cooler than forecast.

Despite solid retail sales and wholesale inflation data, markets remained choppy midweek as geopolitical tensions and uneven earnings results from select financial firms weighed on sentiment.

Late-Week Rebound Limits Losses

Later in the week, chip manufacturers and large banks led a rebound that erased much of the prior declines. Markets opened higher on Friday before retreating again after renewed speculation surrounding the president’s preferred candidate for the next Federal Reserve Chair.

By week’s end, investors appeared to look past the policy drama, focusing instead on earnings momentum and upcoming economic data. While volatility remained elevated, selling pressure eased compared with earlier in the week.

This Week: Key Economic Data

Wednesday

Construction Spending* (November)

Pending Home Sales

Thursday

Weekly Jobless Claims

Gross Domestic Product, Q3 (first revision)

Personal Consumption Expenditures (PCE) Index* (November)

Friday

Consumer Sentiment

Purchasing Managers’ Index (PMI), Services and Manufacturing

* Report publication delayed by the government shutdown in October and November

This Week: Companies Reporting Earnings

Tuesday

Netflix, Inc. (NFLX)

Interactive Brokers Group, Inc. (IBKR)

3M Company (MMM)

U.S. Bancorp (USB)

Wednesday

Johnson & Johnson (JNJ)

The Charles Schwab Corporation (SCHW)

Prologis, Inc. (PLD)

Thursday

Procter & Gamble Company (PG)

GE Aerospace (GE)

Intel Corporation (INTC)

Abbott Laboratories (ABT)

Intuitive Surgical (ISRG)

Capital One Financial Corporation (COF)

My three eyes blink, and I give you commands.

Although I can’t see, the changing colors in me prompt you to obey me with your wheels, feet and hands.

What am I?

Footnotes And Sources

1. WSJ.com, January 16, 2026

2. Investing.com, January 16, 2026

3. CNBC.com, January 12, 2026

4. WSJ.com, January 12, 2026

5. WSJ.com, January 13, 2026

6. WSJ.com, January 13, 2026

7. CNBC.com, January 14, 2026

8. CNBC.com, January 16, 2026

9. IRS.gov, August 15, 2025

10. Investors Business Daily, Econoday economic calendar, January 16, 2026. Forecasts are based on assumptions and are subject to revision.

11. Zacks, January 16, 2026. Companies listed are for informational purposes only and should not be considered investment recommendations.

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Bethesda Wealth Planning Group.