Investment Opportunity through Risk: The Price We Pay

Every investment carries a range of possible outcomes. Some outcomes fall into the downside (severity), and others fall into the upside (opportunity). Opportunity represents the magnitude of the positive outcomes if things go well. Understanding opportunity helps investors realize that risk is a necessary component to long-term success.

Key Takeaways

- Risk describes the probability of outcomes.

- Opportunity describes the magnitude of positive outcomes when they occur

- Opportunity can seem invisible while losses can be loud

- Staying invested matters more than predicting short term movements

- Long term financial success is built on capturing opportunity rather than avoiding discomfort

What Opportunity Really Means for Investors

Opportunity is the upside potential created by taking risk. It is the size of the gain that becomes possible if the favorable outcome occurs. In statistical terms, opportunity represents the positive skewness of returns, where a small number of outsized periods can shape a lifetime of results.

The Capital Asset Pricing Model (CAPM), by William Sharpe, defines this relationship. It explains that investors must be compensated for taking risk and that expected returns should exceed the “risk-free rate”. In simple terms, if you can earn 3.5% in a high yield savings account with essentially no risk, then investing in something riskier should offer a higher expected return than that safe 3.5%. That additional potential return is the opportunity created by risk. Risk creates opportunity. The question is, how much?

Why Investors Often Miss Opportunity

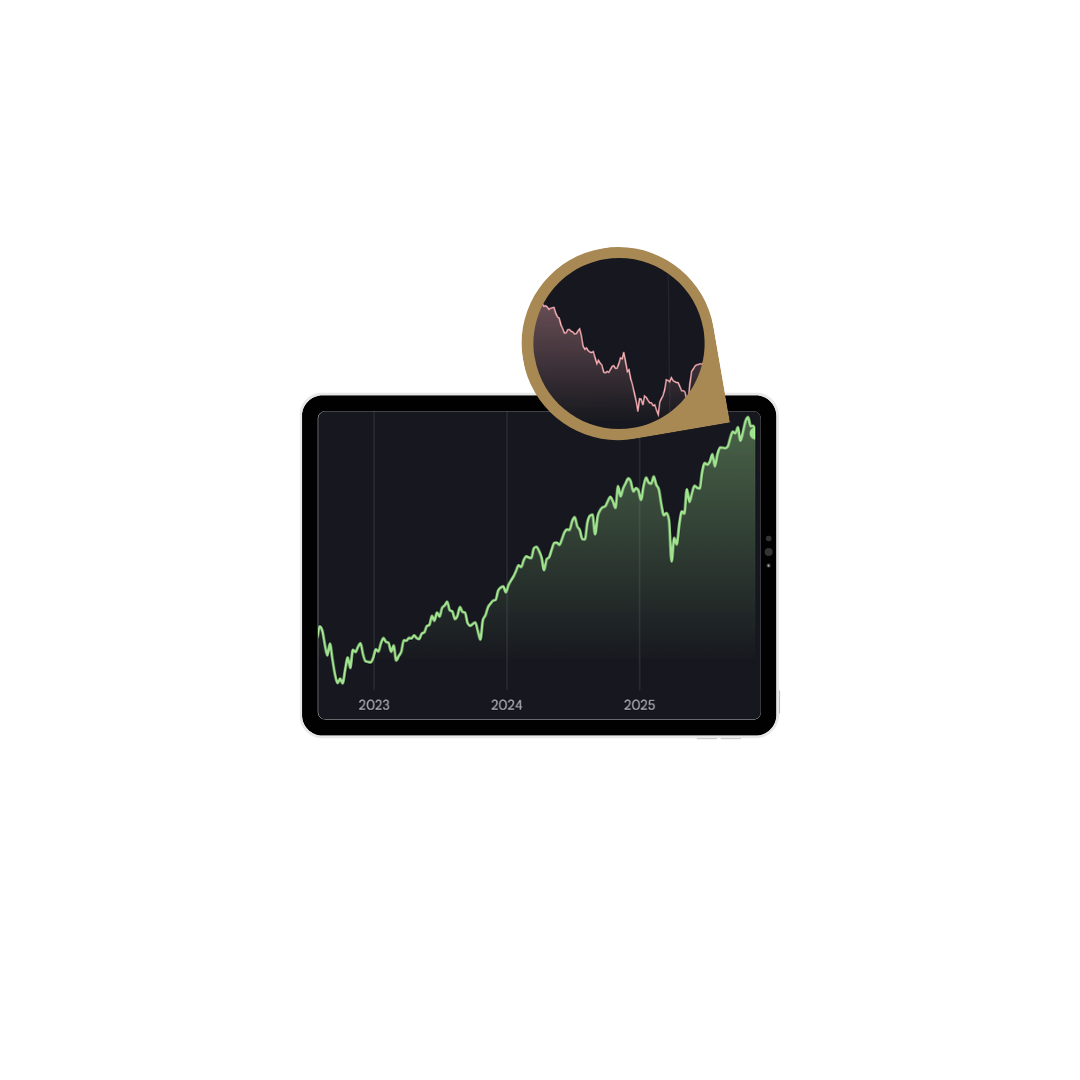

$10,000 investment in the S&P500 from 2005 to 2025

Source: JP Morgan Asset Management

1. Losses feel more painful than gains feel rewarding

Behavioral finance research consistently shows that people experience losses roughly twice as intensely as gains of the same size. This bias, known as loss aversion, causes investors to fixate on the downside while ignoring the magnitude of the upside. Even when the expected opportunity is significant, the emotional weight of potential loss can overshadow it.

This explains why many investors abandon strong long-term strategies during temporary declines. The severity feels immediate. The opportunity feels invisible.

2. Short-term noise hides long-term potential

Markets can swing sharply over days or months, and many investors interpret those movements as meaningful signals rather than background noise. In reality, much of long-term

performance comes from rare, powerful upside periods.

Missing even a few of these moments can radically change outcomes.

As of November 20th 2025, the S&P500 lost 2.7% over the past 5 days. Over the last 5 years, the S&P500 is up 86.7%

For example, research on the S&P 500 shows that missing the best 10 to 20 days over a 20-year period can cut returns by half. These days often cluster around periods of heightened volatility, meaning investors who step out “until things calm down” often miss them.

This is why the phrase “If in doubt, zoom out” resonates. The farther back you view markets, the more obvious the opportunity becomes and the less meaningful short-term swings appear.

3. Opportunity does not show up on a statement

Losses appear in bold on an account statement and demand your attention. Meanwhile, opportunity is silent. You cannot see the growth you failed to capture. You only see your current balance. This can cause investors to underestimate the upside potential of risk-taking and overestimate the safety of avoiding discomfort.

Once investors understand that opportunity is invisible in real time but powerful over decades, their behavior becomes far stronger and more consistent.

Time Horizon and the Nature of Opportunity

Time horizon shapes how much opportunity an investor can realistically capture.

Over short periods, opportunity is harder to realize because markets can move in any direction. The probability of experiencing strong upside is limited, and volatility tends to dominate.

Over long periods, the probability of capturing meaningful opportunity increases as compounding does most of the work. Temporary declines fade into the background because the accumulated gains from strong periods begin to outweigh them.

This is why long-term investors benefit from maintaining exposure to growth assets. Their time horizon gives enough room for opportunity to strike and compound.

Using Opportunity to Become a Better Investor

Opportunity helps investors see risk in the proper context. It reminds them that:

Volatility is the cost of admission to meaningful opportunity.

Strong returns often come from a few exceptional periods and it is difficult to predict when they occur.

Staying invested matters more than predicting short-term movements.

Long-term financial success is built on capturing opportunity, not avoiding discomfort.

A disciplined investor evaluates:

Risk: the probability of outcomes

Severity: the magnitude of negative outcomes

Opportunity: the magnitude of positive outcomes

Every investment decision involves a trade-off between the two ends of the distribution. The downside has a severity and the upside has opportunity. Investors make better decisions when they evaluate both sides instead of reacting only to what feels uncomfortable in the moment.

When all three are understood together, the rationale for long-term investing becomes clear, and the behavior needed to stay disciplined becomes easier to sustain.