When Retirees Should Invest Like They’re in Their 30s

Many retirees reach a stage where their savings are more than enough to support their lifestyle. At that point, the question becomes less about whether the money will last and more about how to position wealth for children, grandchildren, or future charitable intentions. The key is simple: every dollar needs a clear purpose. When you separate retirement income dollars from legacy dollars, you protect your lifestyle from market downturns, support long term retirement income, and allow wealth earmarked for heirs to grow in a way that matches its true time horizon.

Key Takeaways

- Retirees with more than enough should earmark dollars for specific purposes rather than treating everything as one large pot.

- Legacy dollars often have a longer time horizon and may warrant a growth oriented investment approach.

- Retirement income can remain invested for stability and dependable withdrawals, while next generation dollars can absorb longer market cycles.

- Tools like Roth conversions, taxable accounts with step-up in basis potential can offer opportunities for effective wealth transfer.

- Planning ahead helps ensure each dollar supports your income needs or your wealth transfer goals.

Why Purpose-Based Investing Matters in Retirement

Most retirees think of their portfolio as a single bucket that must support everything. But when you mix lifestyle needs, near term expenses, and long term legacy goals together, the investment allocation usually skews too conservative. That can hold back growth on money that is actually meant for children or grandchildren decades from now.

Purpose-based investing creates clarity. Instead of guessing which account to draw from and when, each group of dollars is assigned a job. Retirement income dollars are invested for steadiness and resilience. Legacy dollars are invested based on the time horizon of your son in his 30s.

When Legacy Dollars Should Look Like a 30 Year Old’s Portfolio

A 30-year-old has one major investment advantage: time. They can absorb market cycles, recessions, policy changes, and recoveries because their goals are far in the future. The same is true for money you plan to leave to your heirs.

If the goal is to transfer wealth in 20 or 30 years, the investment strategy should reflect that timeline. Short-term market volatility becomes less important than long-term growth. A retiree who invests all their money conservatively often unintentionally limits the future value available for the next generation.

When legacy dollars are separated out, those funds can be invested for long-term growth, even while your personal retirement income remains secure and stable.

Choosing the Right Accounts for Multi-Decade Growth

Legacy focused dollars can be positioned in different account types depending on the accounts you own at retirement and your desired outcome:

Roth IRAs

Often retirees’ smallest account, but it can be great for heirs because of the tax-deferred growth and tax-free withdrawal.

Roth conversions can be planned through retirement. It is important to consider the tax impact of each conversion along with the potential tax savings that can occur when performed before required minimum distributions (RMD). This is why it is important to foster a ‘lifetime tax obligation’ perspective rather than assessing your taxes year by year.

Taxable Investment Accounts

These accounts receive a step up in cost basis at death, which can significantly reduce capital gains for heirs. Earmarking this account that may be funded with leftover pension income can be an excellent way to transfer wealth.

Pre Tax Retirement Accounts

Traditional IRAs and 401(k)s can also be earmarked for legacy planning. Even though heirs must follow distribution rules, the assets still benefit from decades of potential growth and tax-deferral before transfer.

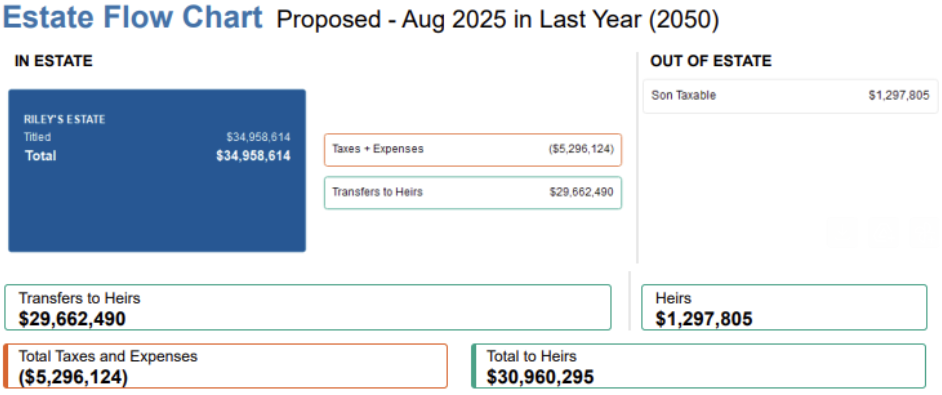

A Note on Estate Strategies

Some retirees will need to look at strategies that remove assets from their taxable estate. This may be due to state estate tax limits imposed on you because of your residence or due to the federal exemption. Although this is not within the scope of this article, tools such as irrevocable trusts or structured gifting strategies can complement the long-horizon investment approach when coordinated with an estate planning attorney.

The key is deciding ahead of time which accounts will support retirement income and which accounts will support legacy goals.

Protecting Your Retirement While Supporting the Next Generation

Investing more aggressively with legacy dollars does not mean putting your lifestyle at risk. Retirement income dollars remain invested appropriately for dependable withdrawals, avoiding sequencing risk and market timing concerns. With the right structure, retirees can:

Maintain a reliable income strategy

Protect themselves from downturns

Support long-term wealth transfer

Reduce unnecessary taxes

Ensure every dollar is working toward their goals

Purpose-based planning helps retirees feel confident in both their current lifestyle and the legacy they are building.