Weekly: Mixed Markets After Fed Decision

Stocks finished last week mixed as investors balanced fourth-quarter earnings results, a widely anticipated Federal Reserve decision, and several key economic reports. While U.S. indexes struggled to gain traction, international markets showed relative strength.

Key Takeaways

U.S. stock indexes ended the week mixed following the Fed’s January meeting

Corporate earnings results contributed to uneven sector performance

Inflation data and policy headlines weighed on sentiment late in the week

Developed international stocks outperformed U.S. markets

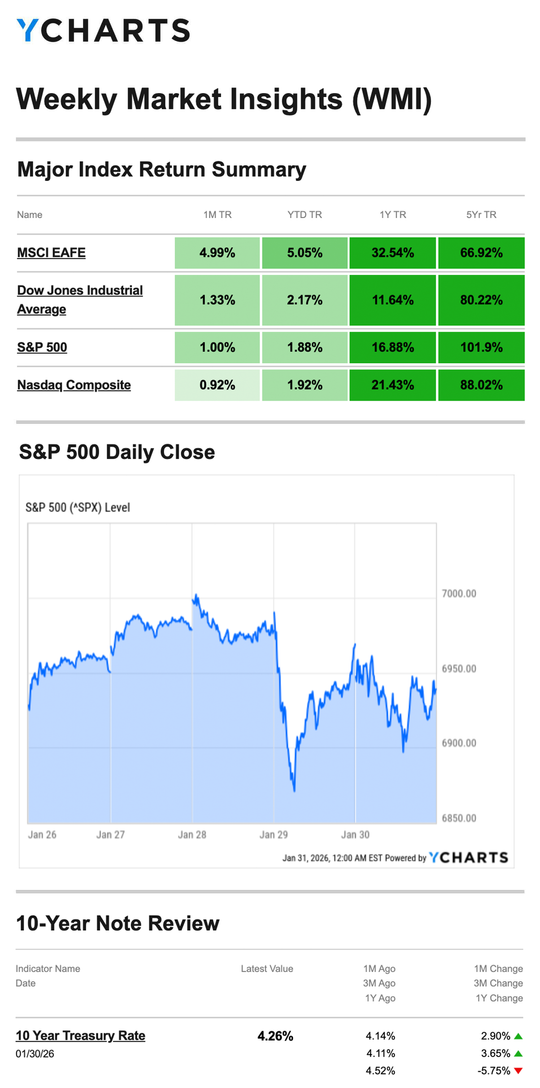

Source: YCharts.com, January 31, 2026. Weekly performance is measured from Monday, January 26, to Friday, January 30.

Market Performance Snapshot

The S&P 500 Index rose 0.34% for the week, while the Nasdaq Composite edged down 0.17%.

The Dow Jones Industrial Average declined 0.42%. In contrast, developed international stocks advanced, with the MSCI EAFE Index gaining 1.22%.

Markets reflected a cautious tone as investors weighed earnings results against evolving policy and inflation expectations.

Markets Digest the Fed and Earnings

Stocks moved higher early in the week as investors positioned ahead of the Federal Reserve meeting and several large corporate earnings announcements. The S&P 500 briefly touched the 7,000 level, reflecting optimism around growth and earnings resilience.

On Wednesday, the Federal Reserve held interest rates steady, a decision that was broadly expected. Market reaction was muted, with little movement across the major indexes by the close. However, disappointing earnings results from a large technology company released after the market closed weighed on sentiment and contributed to weakness in the Nasdaq on Thursday.

Policy Headlines and Inflation Pressure

Markets opened lower on Friday following the White House’s nomination of Fed veteran Kevin Warsh as the next Federal Reserve Chair. Investor sentiment was further pressured by a warmer-than-expected wholesale inflation report for December and renewed concerns around a potential government shutdown.

At its January meeting, the Federal Reserve held the federal funds rate in a 3.5 percent to 3.75 percent target range. This followed three consecutive rate cuts and marked the first pause since July. The next Federal Reserve meeting is scheduled for mid-March.

This Week: Key Economic Data

Monday

Auto Sales

Institute for Supply Management (ISM) Manufacturing Index

Tuesday

Institute for Supply Management (ISM) Services Index

Job Openings (December)

Wednesday

ADP Employment Report

Thursday

Weekly Jobless Claims

Atlanta Fed President Raphael Bostic speaks

Friday

Jobs Report

Consumer Sentiment

Consumer Credit

This Week: Companies Reporting Earnings

Monday

Palantir Technologies Inc. (PLTR)

The Walt Disney Company (DIS)

Tuesday

Advanced Micro Devices, Inc. (AMD)

Merck & Co., Inc. (MRK)

PepsiCo, Inc. (PEP)

Amgen Inc. (AMGN)

Pfizer Inc. (PFE)

Chubb Limited (CB)

Wednesday

Alphabet Inc. (GOOG, GOOGL)

Eli Lilly and Company (LLY)

AbbVie Inc. (ABBV)

Uber Technologies, Inc. (UBER)

QUALCOMM Incorporated (QCOM)

Boston Scientific Corporation (BSX)

CME Group Inc. (CME)

McKesson Corporation (MCK)

Thursday

Amazon.com, Inc. (AMZN)

ConocoPhillips (COP)

Bristol Myers Squibb Company (BMY)

KKR & Co. Inc. (KKR)

Friday

Philip Morris International Inc. (PM)

Note this sequence: B, C, D, E, G. What letter should then follow as the sixth letter in this series?

Last Week's Riddle: The more of these you take, the more of these you will likely leave behind. What are they?

Answer: Footsteps and footprints.

Footnotes And Sources

1. WSJ.com, January 30, 2026

2. Investing.com, January 30, 2026

3. CNBC.com, January 26, 2026

4. CNBC.com, January 27, 2026

5. CNBC.com, January 28, 2026

6. WSJ.com, January 29, 2026

7. CNBC.com, January 30, 2026

8. WSJ.com, January 28, 2026

9. IRS.gov, July 8, 2025

10. Medical News Today, August 25, 2025

11. Investors Business Daily, Econoday economic calendar, January 30, 2026. Forecasts are based on assumptions and are subject to revision.

12. Zacks, January 30, 2026. Companies listed are for informational purposes only and should not be considered investment recommendations

This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with Bethesda Wealth Planning Group.