Tax Concerns for Generational Gifting

Learn how coordinated 529 and UTMA gifting strategies, combined with tax awareness, can support multigenerational wealth planning.

Selling Your Home? Here’s How Taxes on the Profit Work

Learn how the Section 121 home sale exclusion works, including gain limits, ownership rules, exceptions, and how prior use or improvements can affect the taxable outcome.

Are Robo-Advisors Really Low Cost? The After-Tax Picture Tells More

Robo-advisors offer low fees, but taxes from trading and distributions can impact your true return. Learn why net cost should include both platform fees and after-tax results.

The Backdoor Roth: High-Income Households Shouldn’t Skip This

Learn why the overlooked Backdoor Roth should be considered a staple for high-income households. Understand its limits, spousal IRA options, and key rules.

Tax Planning with a Pension: Why Strategy Changes for FERS Retirees

Pension retirees face a higher tax floor in retirement than non-pension retirees. Learn how FERS and other pension households can plan for taxes through Social Security timing, RMD management, Roth strategies, taxable accounts, and early pre-retirement planning.

Your End of Year Financial Checklist

A simple year end financial checklist covering retirement deadlines, tax moves, FSA and HSA rules, Roth conversion timing, and key planning reminders to prepare for the new year.

New 2026 Tax Changes You Should Know

A clear breakdown of the tax changes coming in 2025 and 2026, including updated tax brackets, standard deductions, SALT limits, retirement contribution increases, and new charitable giving rules.

Is My Money Really Safe in a HYSA? Understanding All Risks

A high yield savings account protects your balance, but taxes and inflation can still reduce your real return. Learn when a HYSA makes sense and where it falls short.

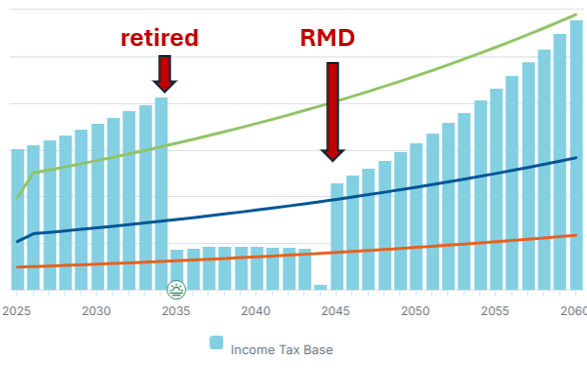

The Retirement Tax Valley before RMDs

Learn how the tax valley between retirement and RMDs can help you manage tax brackets, reduce future RMDs, and create a more flexible retirement income plan.

When Retirees Should Invest Like They’re in Their 30s

Retirees with more than enough savings can invest legacy dollars with a long time horizon. Learn how separating income needs from wealth transfer goals helps protect retirement and support tax efficient growth for heirs.

The Affluent Dilemma: Retirement Income or Wealth Transfer?

How affluent families balance retirement income planning and wealth transfer strategies.

The Most Overlooked Wealth-Building Tool During Open Enrollment

Many companies are in the middle of open enrollment season so it is a great time to revisit the Health Savings Account (HSA)- a savings tool that is often overlooked but offers meaningful long-term benefits.

Tax Credit Sampler

A tax credit reduces the income tax you may have to pay. Unlike a deduction, which reduces the income subject to tax, a credit directly reduces the tax itself.

Year-End Tax Planning Basics

The window of opportunity for many tax-saving moves closes on December 31, so it's important to evaluate your tax situation now, while there's still time to affect your bottom line for the 2024 tax year.