Is My Money Really Safe in a HYSA? Understanding All Risks

A high yield savings account (HYSA) feels like the safest place to keep cash. Your balance never goes down, interest gets added quietly in the background, and you avoid market swings. For short-term needs, that simplicity is helpful. But “safe” can be misleading. When you consider inflation and taxes, the real return of a HYSA can be negative even when interest rates look attractive.

Disclaimer: Before making investment or tax decisions, please consult a financial professional. This article speaks generally to the utility of High Yield Savings Accounts. Everyone’s situation deserves careful consideration before investment changes are made.

Key Takeaways

- HYSAs protect your balance, but inflation and taxes can quietly reduce your real return

- HYSAs are a strong place for short-term needs like emergencies or near-term purchases

- For long-term goals, a HYSA often loses purchasing power over time and its use becomes questionable

- Safety should be measured by what your money can buy in the future, not just the number on the screen

- Using a HYSA with intention helps support your overall financial plan

What a HYSA Really Protects

A HYSA protects the nominal value of your savings. If you deposit $100,000, you will see $100,000 tomorrow. That stability is valuable for money you may need soon. There is no market movement, and FDIC insurance* (or NCUA for credit unions) adds another layer of protection.

But that protection only applies to the account balance you see on the screen. The purchasing power of that money still changes. That is where many people overlook risk.

*FDIC insurance will often protect up to $250,000 per insured bank.

Real Rate of Returns: The Risk you don’t see

Real return measures how your money performs after inflation. Even if the balance in your HYSA never goes down, the value of what that money can buy may still shrink.

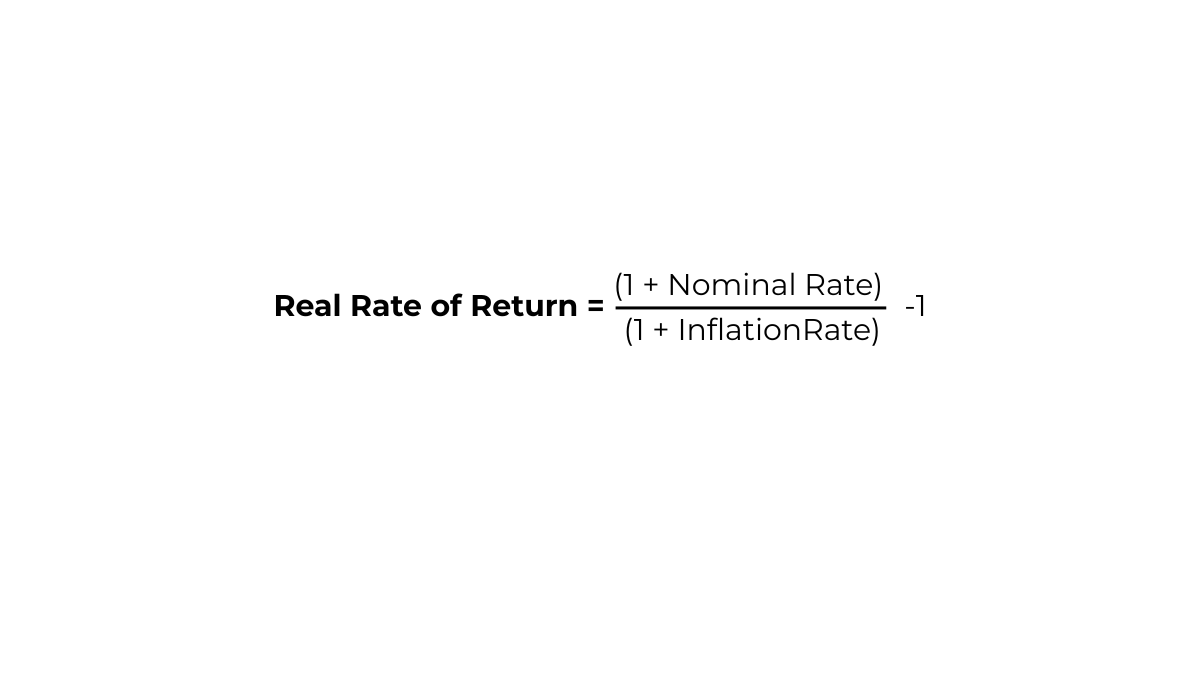

Let’s look at an example using this formula:

HYSA nominal rate: 4%

Inflation: 3%

Real Return: ~1%

We can go a step further and factor in taxes applied to the HYSA interest that we are receiving. This will be found on tax form 1099-INT.

Assuming a 25% income tax rate, the 4% interest looks closer to 3% after taxes.

Let’s look at this formula again:

On paper, your money is earning 4% but after taxes and inflation, your purchasing power can begin to move in the other direction depending on your tax rate. The number in your account is protected, but the value behind that number can still erode.

Helpful Tip 💡: In January, when you receive your tax documents, review the interest from your savings accounts as well as the dividends from your investments (1099-DIV). These hidden costs should be factored into your investment decisionmaking and your net return.

Where the HYSA can Fit

A HYSA works best when the time horizon is short and the purpose is clear.

Good uses include:

• Emergency fund

• Travel savings

• A home repair or upgrade later this year

• Property tax or insurance payments

• Funds you expect to use within the next 12 to 24 months

In these situations, avoiding volatility matters more than beating inflation. You want the money ready and predictable.

When a HYSA Becomes “Too Safe”

For long-term goals like retirement, education funding, or wealth building, a HYSA can be too conservative. Over long periods, inflation becomes the main risk. If the goal is many years away, keeping large balances in cash increases the chance that your money will not keep pace with rising costs.

Many people shift into a HYSA during periods of volatility because it feels like the safer choice. This move is usually reactive rather than strategic. The challenge is that markets often recover faster than people expect. By the time someone feels comfortable reinvesting, much of the rebound has already passed. The result is a long-term setback created by a short-term search for comfort.

A HYSA Is a Tool, Not a Strategy

Think of a HYSA as one part of your financial plan, not the plan itself. It provides stability. It gives you flexibility. It supports your confidence during emergencies. But it cannot replace a long-term strategy that considers time horizon, taxes, and inflation.

Using it with intention is the key. Decide what the money is for, how soon you might need it, and whether the priority is stability or long-term value.