Are Robo-Advisors Really Low Cost? The After-Tax Picture Tells More

Robo-advisors are widely viewed as an affordable and accessible way to invest. For cost-conscious investors, this matters. Evidence shows that lower investment costs support stronger long-term performance. But there is another part of the cost conversation that often gets overlooked. Taxes.

Even if a strategy charges a small platform fee, the activity inside the portfolio can quietly reduce your return. This after-tax impact can be the difference between a strategy that seems low-cost on the surface, but ends up packing a punch closer to 2%.

This article takes a closer look at why taxes matter just as much as fees when evaluating your investment approach.

Disclaimer: This is for educational purposes only and should not be considered advice. Before making changes to your investments, please review with a financial professional and/or tax professional.

Key Takeaways

- When reviewing investment cost, taxes are often neglected from the formula

- Algorithmic tools keep portfolios on track, but they may not be tailored for your personal tax situation.

- Investors in high-tax states should pay closer attention to their 1099-DIV & 1099-INT forms

- Robo-Advisors provide a level of convenience that may be difficult to quantify

The Appeal of Robo-Advisors

The strength of robo-advisors is clear. They offer diversified portfolios and automated management at a fraction of the cost of traditional platforms. For many investors early in their financial journey, this removes the fear of investing on their own and encourages them to start sooner than they might have without it. As we know, ‘Time in the market’ is important, so this is a considerable benefit to having robo-advisors as an option.

The caution is not about fees. It is about understanding that the total cost of an investment strategy includes what you pay to the platform and what you pay in taxes. This is especially important in taxable accounts, where the timing and nature of portfolio activity are instrumental to the total cost.

A strategy that costs 0.25% on paper could feel closer to 2% or more after factoring in tax costs if there is frequent turnover or inefficient distribution activity.

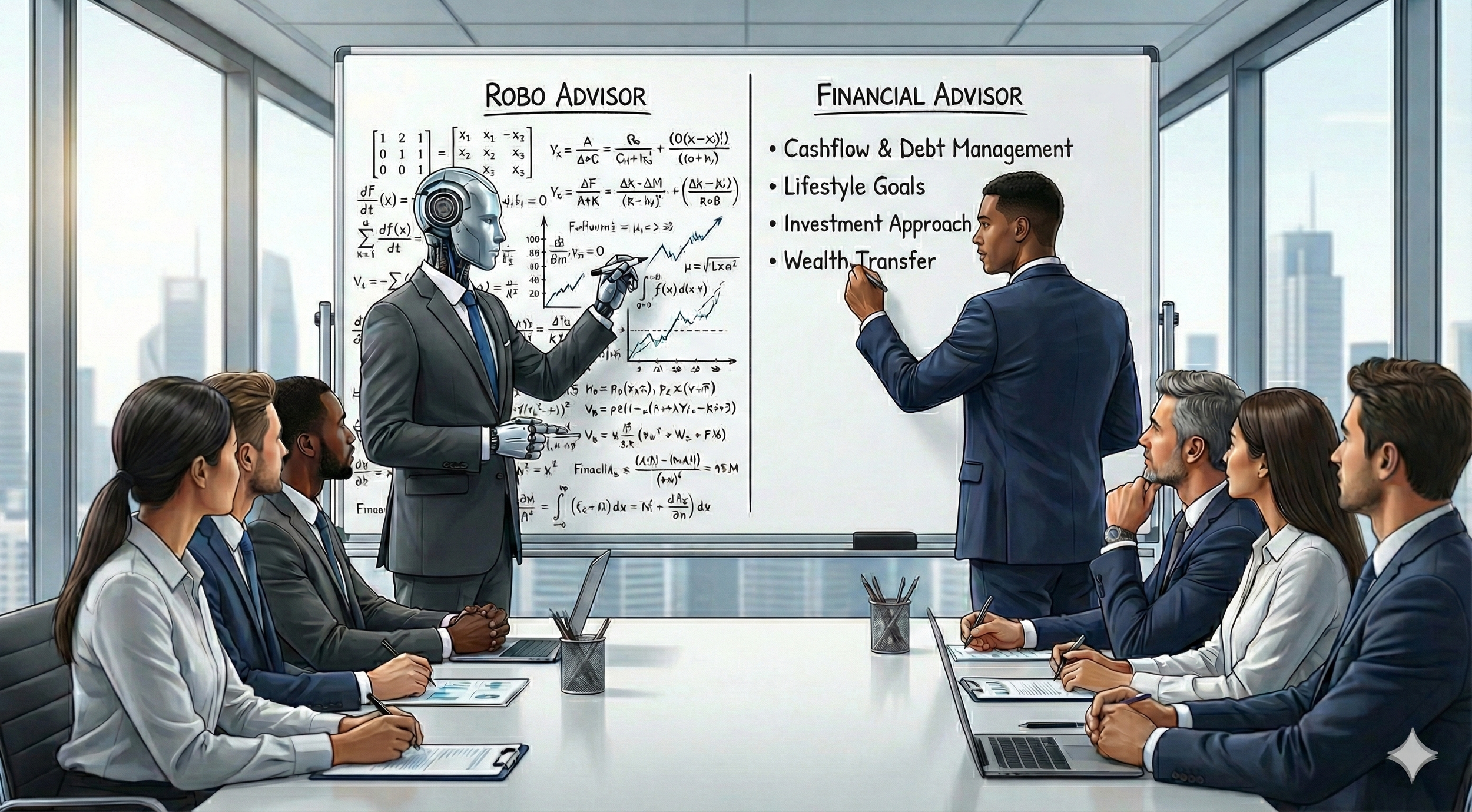

Algorithms Are Efficient, But Not Personal

Robo-advisors rely on algorithms that follow rules, thresholds, and models. However, they may not consider your personal situation outside the scope of your investment account. This means:

They cannot adjust rebalancing decisions around your specific tax bracket.

They may trigger gains in years when your income is unusually high due to commissions or bonuses.

They may not optimize around state-level tax rules or meaningful changes in your life.

They may rebalance at times when doing nothing would have been more tax-efficient.

None of this makes the platforms bad. It simply highlights that efficiency and personalization may not always go hand-in-hand. In a tax-deferred account, this is less of an issue. In a taxable account, it can be more noticeable.

The Tax Cost That Many Investors Do Not See

Research shows that taxes can create meaningful drag on returns in automated portfolios.

A 2025 Morningstar report reviewing 16 robo-advisors found that platforms without daily tax-loss harvesting lagged in tax efficiency by 0.5% to 1.5% per year, largely due to unharvested losses and ETF distributions averaging 1 to 2% of assets.

A Forbes Advisor’s analysis of 18 platforms reported $500 to $2,000 of taxes for every $100,000 invested.

This translates to 0.5% to 2% of annual drag.

Helpful Tip💡: States with high income taxes could add to the problem. For example, California taxes both ordinary and qualified dividends at regular income tax rates. Capital gains are also taxed as ordinary income. This means even modest turnover or distributions inside a taxable portfolio can create a larger-than-expected state tax bill, amplifying the difference between low posted fees and the actual cost investors experience

Include Taxes in the Formula

Cost-conscious investors are doing the right thing by comparing fees. They are simply one step away from a complete comparison.

A full review should include investment fees and taxes.

The goal is not to dismiss robo-advisors. Many do an excellent job for the right person- I would go as far to say that robo-advising has bridged the gap to investing for many first-timers. Convenience is also difficult to assign a dollar figure to.

The goal is to help investors look at the full picture so they can choose the approach that gives them the best net outcome for their situation.

When you evaluate cost, the real question is: What do I keep after fees and after taxes?