The Backdoor Roth: High-Income Households Shouldn’t Skip This

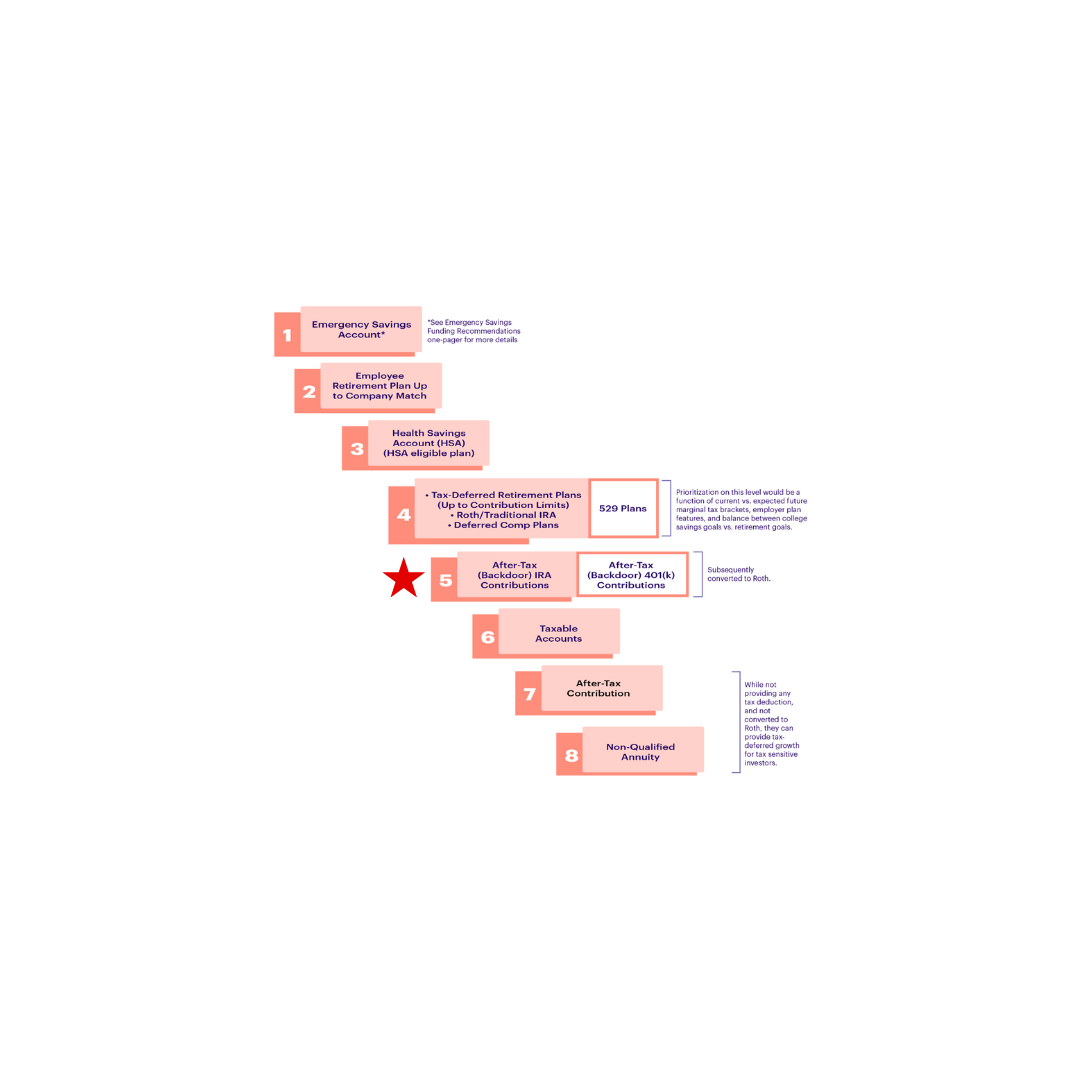

For many high-income households, the savings journey follows a clear structure: build the emergency fund, capture the company match, pay off ‘bad debt’, max the employer plan, then move on to other goals. Somewhere in that sequence sits the Backdoor Roth IRA.

It looks small on the surface, which is why so many skip it and go straight to the taxable account. But for earners who are already maxing their available tax-advantaged accounts, this step plays an important role in wealth building.

Disclaimer: This is for educational purposes only and should not be considered advice. The backdoor Roth may not be appropriate for everyone. Before making changes to your investments, please review with a financial professional and/or tax professional.

Key Takeaways

- The Backdoor Roth is commonly overlooked because the annual contribution amounts are low, and there are multiple steps required

- Before you invest in a taxable account, consider the benefits of a Backdoor Roth

- For high-income households covered by a workplace plan, traditional IRA contributions quickly become non-deductible

- Be mindful of the pro-rata rule when executing the strategy

Why High Earners Often Skip the Backdoor Roth

Source: The American College for Financial Services Financial Priority Waterfall

The most common reason people skip this step is simple. Once they have maxed their 401(k) or TSP, the next move feels like opening a taxable account. A taxable account is easy, flexible, and familiar. A Backdoor Roth, on the other hand, requires a two-step process. Because it requires a little more coordination, many households overlook it even though it can add meaningful tax-free dollars to their retirement.

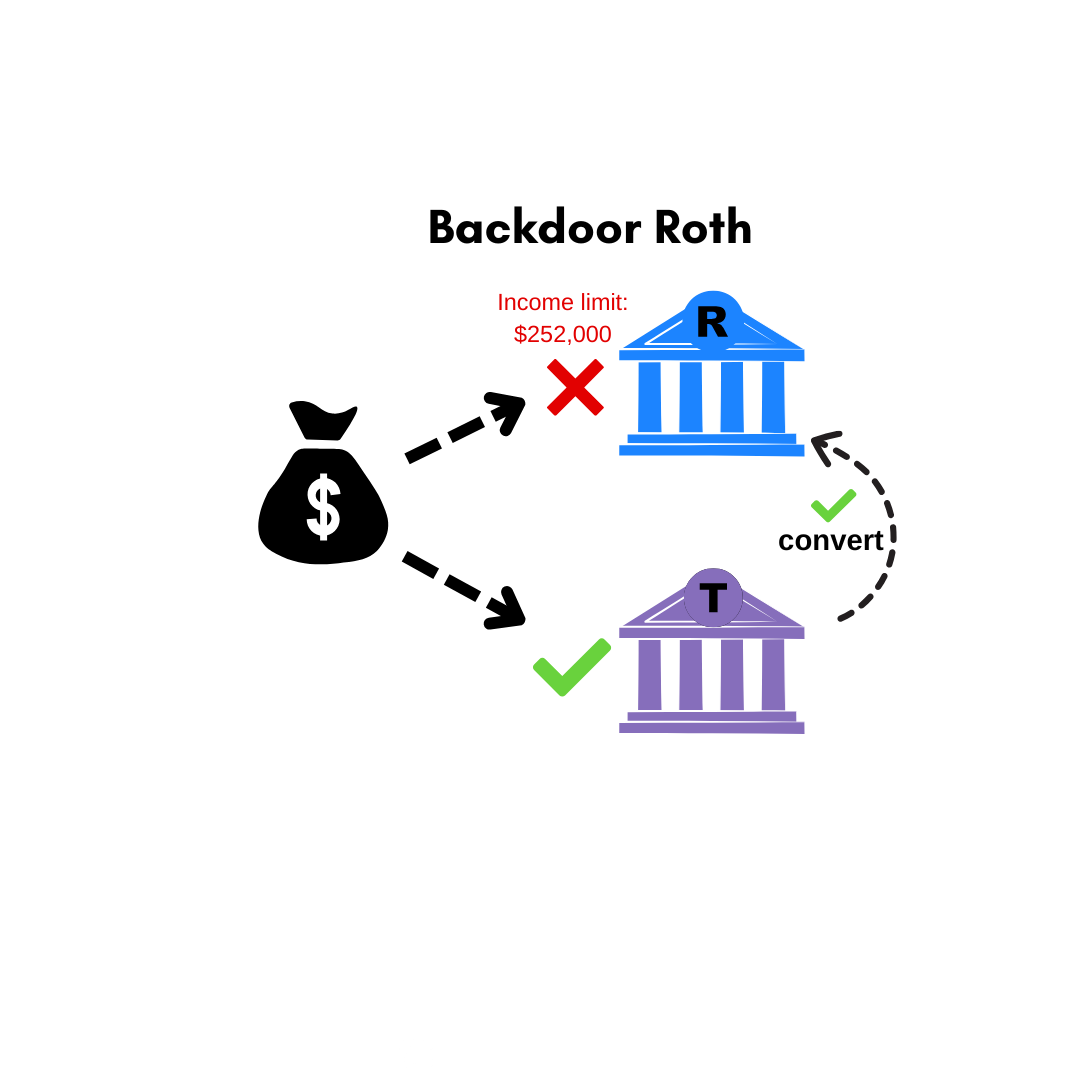

For 2026, the complete phase-out income limits for households are $168,000 if single and $252,000 for married couples. Many people assume that because they make too much, they cannot invest in a Roth IRA. Let me break down how the backdoor Roth IRA works:

Roth IRAs limit one’s ability to contribute based on income

Traditional IRAs do not have an income limit

You can elect to make an after-tax contribution to your traditional IRA

Then you can perform a conversion. This converts the dollars in a traditional IRA into a Roth IRA

But wait! You just said there are income limits?! Yes, for Roth IRA contributions, not conversions

Helpful tip 💡: If you are married filing separately, the income limit for Roth IRA contributions is only $10,000.

If you are filing separately, you and your spouse need to be aware of this.

Should you Consider This Step?

As a high earner, you are likely in high-income tax brackets. Therefore, you might favor tax deferral over paying taxes now in plans like you’re the 401K or TSP. Once your pre-tax options have been maximized, you will need to determine what to do with your after-tax surplus. This is where the backdoor Roth fits in.

Even though the annual Roth IRA contribution limits are small (for 2026: $7,500 and $8,600 for those above 50), they add up overtime:

Tax-free growth and withdrawals

No required minimum distributions

More flexibility when managing future tax brackets

Why not a Traditional IRA instead?

Many high earners assume they can still contribute to a traditional IRA and receive the same benefits as their earlier working years. But the tax deduction is the entire reason a traditional IRA works. And for those covered by an employer plan:

The deduction phases out at relatively modest income levels

(for 2026: $91,000 if single and $149,000 if filing jointly)Once income rises above those thresholds, traditional IRA contributions become non-deductible.

At that point, the traditional IRA loses nearly all of its intended value. You contribute after-tax dollars, but future growth is taxed as ordinary income, and the account is still subject to required minimum distributions.

This is why a non-deductible traditional IRA held on its own can be questionable.

Spousal IRA: A Simple Way to Double the Strategy

If one spouse has little or no earned income, households can often contribute to a spousal IRA funded by the working partner’s income.

This allows a couple to:

Make two traditional IRA contributions

Complete two Backdoor Roth conversions

Double the annual amount shifted into tax-free growth

For households focused on building a larger Roth footprint, this is an easy and often overlooked extension.

Be Aware of the Pro-Rata Rule

Executing the Backdoor Roth requires a clean IRA environment.

If you hold pre-tax IRA dollars (traditional, SEP, SIMPLE), the IRS aggregates them when calculating how much of your conversion is taxable.

For Example, You might have a non-deductible IRA worth $8,000 and a Traditional IRA worth $72,000. If you choose to convert the non-deductible IRA worth $8,000, the IRS treats ALL of your IRA dollars as a fraction. In this instance, there are $80,000 total IRA dollars- $72,000 is pre-tax and $8,000 is after tax. Therefore, 90% is pre-tax and 10% is after tax. Despite choosing to convert the non-deductible IRA that’s worth $8,000, it will be taxed as though 90% of it is pre-tax and 10% of it is after tax.

To avoid this, consider:

Roll pre-tax IRA balances into an employer plan if allowed, or

Convert those balances intentionally as part of a broader strategy

Once the IRA landscape is clean, annual Backdoor Roth contributions become straightforward.

Conclusion: Many Moving Parts

For high-income households who have already filled their available tax-deferred space, the Backdoor Roth is an important annual step rather than a small afterthought. It adds tax-free dollars to the retirement plan, reduces future tax pressure, and helps create a more flexible income strategy later in life.

Before defaulting to taxable investing, it is worth making sure this small but mighty step is not being missed. Since this strategy may have tax implications, please consult with your Financial professional or tax professional before determining if this is appropriate for you.