Tax Planning with a Pension: Why Strategy Changes for FERS Retirees

Retirement planning often assumes your income will fall once the paychecks stop. For retirees with a pension like FERS or CSRS, the opposite can be true. A pension creates a higher tax floor that stays with you for life. This changes how you plan, when you plan, and which tax strategies actually move the needle.

Disclaimer: This is for educational purposes only and should not be considered advice. Every person’s situation is different and requires diligence when planning for retirement. Please consult with a financial professional or a tax professional before making changes to your investments.

Key Takeaways

- A pension creates a higher tax floor that limits traditional tax valley planning

- There are still effective tax strategies, but they look different from those used by non-pension retirees

- Once the pension starts, many tax levers are no longer available

- Flexibility must be built in advance through a mix of account types, timing decisions, and coordinated income streams

A Pension Creates a Higher Tax Floor

A predictable pension is one of the strongest retirement assets someone can have, but it comes with a tradeoff. The pension creates steady lifetime income that keeps your taxable income elevated year after year.

This removes the traditional “low income” years that non-pension retirees use to shift money from pre-tax to Roth, fill lower brackets, or engineer a tax valley.

For FERS and other pension households:

Income does not naturally drop after retirement

Social Security and RMDs can stack on top of your pension

Tax brackets become more rigid

Options for lowering taxable income are limited

You rarely get the income dip that makes large Roth conversions easy. Your income floor is fixed.

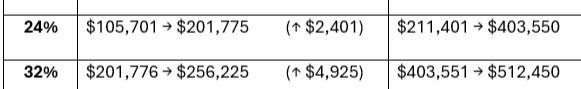

2026 IRS Income Tax Brackets

Helpful Tip 💡: Pay close attention to what income brackets you are between. There is a large jump for incomes nearing the 32% bracket. The progressive tax rate jumps from 24% to 32% when income passes $201,775 for single filers and $403,550 for married couples filing jointly.

What Pension Retirees Can Do to Tax Plan

Even with a higher tax floor, meaningful planning opportunities still exist. They require a different approach.

Delay Social Security to Prevent Too Much Income at Once

Delaying Social Security helps pension retirees avoid stacking two guaranteed income streams prematurely. This can help you create a small window for modest Roth conversions or strategic withdrawals. If there are planned renovations in retirement, this can be a way of strategically funding this goal with taxes in mind.

For those who retire before 70, the years between retirement and the start of Social Security become a valuable planning window.

Manage Future RMDs Intentionally

RMDs can push pension retirees into higher brackets and IRMAA thresholds. To soften the impact:

Convert small amounts to Roth before RMD age

Withdraw strategically in the early years of retirement

Use qualified charitable distributions if charitable intent exists

These steps help prevent RMDs from stacking on top of pension and Social Security income.

Use Roth IRAs to Smooth Spending

The traditional advice of “spend taxable, then tax-deferred, then Roth last” is less useful for pension households.

Roth dollars can be used to:

Cover large expenses without increasing taxable income

Keep your bracket and IRMAA charges stable

Add flexibility during travel years, home repairs, or healthcare shocks

A Roth is a pressure-release valve for a pension household.

Build and Use a Taxable Account

Taxable accounts provide flexibility that pension retirees often need. They allow you to:

Fund spending without raising income

Serve as an overflow bucket for any surplus of guaranteed income

Offset years when other income is high

Over a long retirement, a taxable account becomes an essential planning tool.

Consider Relocating to a Tax-Friendly State

State taxes can significantly affect lifetime tax exposure so if relocating in retirement to be closer to family is a consideration, that may pair with your retirement distribution strategy.

No state income tax states:

Alaska

Florida

Nevada

South Dakota

Texas

Washington

Wyoming

Although federal taxes still apply.

Pre-Retirement Planning Matters More Than Ever

For pension retirees, most of the meaningful tax planning must happen before the pension starts. Once your pension is locked in, your income is locked in. You cannot reverse it, slow it, or reduce it.

This creates a simple truth:

Pension retirees must design flexibility in advance.

The 10 years before retirement carry the most leverage. This is when decisions about the following can create impact:

Savings mix

Roth vs pre-tax contributions

Taxable account funding

Early Roth conversions

Withdrawing or shifting pre-tax balances

If a pension retiree retires with:

A large pension

A large pre-tax balance

Little to no Roth savings

Minimal taxable money

There is limited room to maneuver. Their tax bracket is essentially fixed. They may pay higher lifetime taxes, face IRMAA challenges, and have fewer ways to manage spending shocks.

Good planning solves this in advance.

A Different Retirement Requires a Different Strategy

Pensions provide stability, security, and peace of mind. They also create a higher tax floor that limits classic retirement tax planning strategies. Pensions have become a rare employer benefit and they make a world of difference for retirement income planning. The same way that you committed to 30 years of service to provide you and your family with a retirement benefit, you should also consider planning years in advance to know where the pension fits in your overall plan.

A pension is a powerful asset. The right planning makes it even stronger.