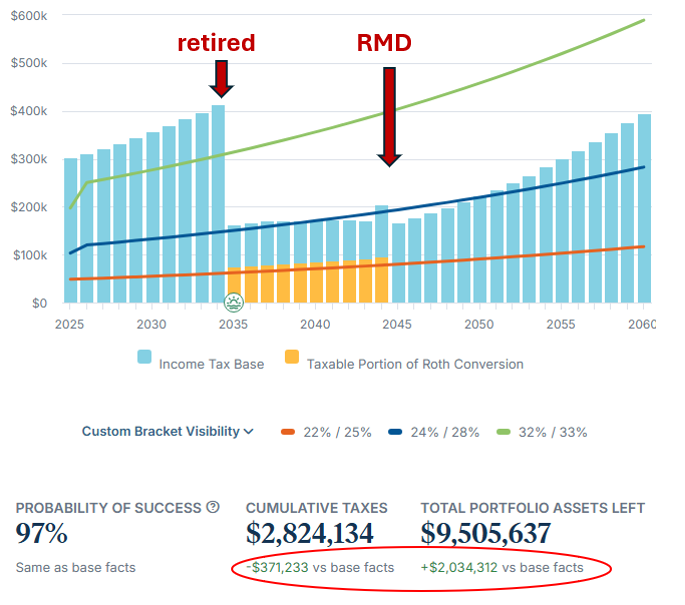

The Retirement Tax Valley before RMDs

Taxes are one of the largest expenses Americans will pay throughout their lifetime. Tax Planning that leads to marginal savings can result in significant lifetime gains. An overlooked area of opportunity for retirees is the Retirement Income Tax Valley. The period between retirement and the start of Required Minimum Distributions can be a time when taxable income drops sharply. During these years, your taxable income becomes flexible, which opens the door to intentional tax planning.

Disclaimer:

This content is for informational and educational purposes only. It is not tax, legal, or investment advice. Work with a qualified financial planner and tax advisor before deciding whether any strategy, including Roth conversions or early withdrawals, is appropriate for your situation. Tax laws can change and individual circumstances vary.

Key Takeaways

- The Tax Valley is the gap between retirement and RMD age, when taxable income often falls

- Early withdrawals or Roth conversions can reduce one’s lifetime tax bill when applied correctly

- Planning must account for potential offsets like IRMAA, tax brackets, and the timing of Social Security

- Many retirees use a “fill the bracket” approach to manage how much to withdraw

What Is the Tax Valley?

Many retirees see their taxable income drop once they stop working. During the years, you might only have portfolio interest, dividends, or partial Social Security benefits. That lower income creates a natural valley in your tax picture.

This window matters because your RMDs will eventually force taxable income back up, sometimes much higher than expected. The goal is to use the valley to your advantage.

Wait for RMDs or Take Early Withdrawals?

A common question is whether it is better to let your retirement accounts grow until RMD age or to start taking withdrawals earlier. There is no universal answer, but here are the core considerations:

1. Early withdrawals can shrink future RMDs

By taking controlled withdrawals during the tax valley, you reduce the future account balance that RMDs apply to. That can lower your taxable income later in retirement and help prevent you from being bumped into higher brackets than you want.

2. You can smooth out your tax brackets

Sometimes it is more efficient to intentionally increase your taxable income during low-tax years. This may feel counterintuitive, but it is a deliberate trade to avoid much higher taxes later.

3. Many retirees “fill the bracket”

This means taking withdrawals (or performing Roth conversions) up to the top of a certain tax bracket without spilling into the next bracket. It provides a clear measuring stick for how much income to add each year.

Example: Use case for Roth conversions in the Tax Valley

Consider a retiree whose taxable income drops once they stop working. They decide to leave their pre-tax accounts untouched until RMD age. This is a common approach and nothing is wrong with it, but it can miss an opportunity to improve long-term outcomes.

Before: Leaving Accounts to Grow Until RMDs

Scenario A: The retiree lets their IRA continue growing until RMDs begin. No early withdrawals or Roth conversions are completed during the tax valley years.

What unfolds:

• Taxable income stays low after retirement

• RMDs cause a large spike in taxable income later

Scenario B: The retiree uses the low-income window to complete controlled Roth conversions, which intentionally raise taxable income early in retirement.

The improvements:

Lifetime tax savings of roughly $371,000

Expected net worth grows

RMD spikes are now smoothed

Key Considerations Before Using the Tax Valley

Tax brackets

Understanding where your taxable income currently sits and how much room remains in each bracket is essential.

IRMAA for Medicare Part B

Even a small increase in income can push you into a higher IRMAA tier. These charges apply two years later, so planning needs to look forward.

Timing of Social Security

Delaying Social Security often extends the size of your tax valley. Starting benefits early may reduce the window.

Market and portfolio considerations

Pulling funds earlier can support a smoother long-term plan but should still fit within your overall investment and withdrawal strategy.

There are no rules of thumb when it comes to Financial Planning. It is important to review your situation along with your wants & wishes to determine if taking advantage of your Tax Valley makes sense.