The 10 Hour Retirement Gift and How to Use It

Discover how to use the extra 10 hours that retirement gives you. Learn how purpose, identity, hobbies, and a strong financial plan can help you build a fulfilling retirement lifestyle.

Your End of Year Financial Checklist

A simple year end financial checklist covering retirement deadlines, tax moves, FSA and HSA rules, Roth conversion timing, and key planning reminders to prepare for the new year.

New 2026 Tax Changes You Should Know

A clear breakdown of the tax changes coming in 2025 and 2026, including updated tax brackets, standard deductions, SALT limits, retirement contribution increases, and new charitable giving rules.

Is My Money Really Safe in a HYSA? Understanding All Risks

A high yield savings account protects your balance, but taxes and inflation can still reduce your real return. Learn when a HYSA makes sense and where it falls short.

10 Questions You Should Ask a Financial Advisor

10 essential questions to ask a financial advisor before hiring one. Understand investment philosophy, planning services, and how to choose an advisor who aligns with your goals.

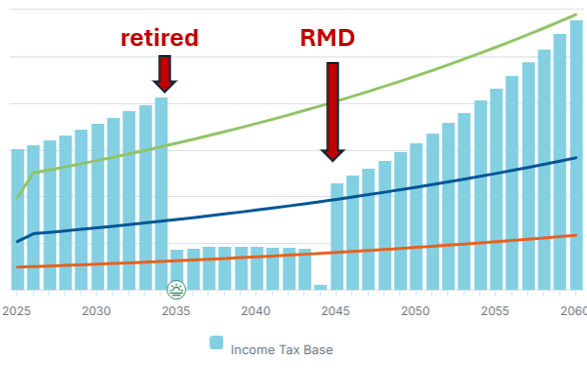

The Retirement Tax Valley before RMDs

Learn how the tax valley between retirement and RMDs can help you manage tax brackets, reduce future RMDs, and create a more flexible retirement income plan.

When Retirees Should Invest Like They’re in Their 30s

Retirees with more than enough savings can invest legacy dollars with a long time horizon. Learn how separating income needs from wealth transfer goals helps protect retirement and support tax efficient growth for heirs.

Investment Opportunity through Risk: The Price We Pay

Opportunity shapes long term investing. This article explains the upside magnitude of outcomes, why investors often underestimate it, and how understanding opportunity helps support stronger investment behavior.

Risk & Severity: What Good Investors Understand

How an understanding of risk and severity helps investors avoid long term mistakes. Learn why understanding severity improves investor behavioral decisions

Risk, Severity & Opportunity: Why Risk Is More Than One Idea

An explanation of risk, severity, and opportunity. As an investor Learn how the magnitude of upside and downside outcomes work together.

‘Asset Segmentation’ Approach to Retirement Income

The dynamic nature of the Asset Segmentation (Bucket) Approach in helping retirees customize their retirement plan.

Predictable Retirement: The ‘Income Protection’ Approach

Learn how the Income Protection approach helps retirees create predictable income for a relaxing retirement.

The ‘Risk Wrap’ Approach to Retirement Income

the Risk Wrap approach helps retirees and employees with pensions balance market growth and predictable income through diversified, structured retirement planning.

The ‘Total Return’ Approach to Retirement Income

Learn how the Total Return approach creates flexible retirement income through market growth, disciplined withdrawals, and coordinated financial planning.

The Overlooked Exit Plan for Small Businesses

Many small business owners build companies that cannot run without them. Learn how exit planning can help protect your legacy and secure your financial future.

The Affluent Dilemma: Retirement Income or Wealth Transfer?

How affluent families balance retirement income planning and wealth transfer strategies.

The Role of L Funds for Federal Government Employees

Learn how TSP L Funds work, what they are made of, and how to decide between L Funds and individual TSP funds. Understand how glide paths change over time and why investing with purpose matters.

Understanding Risk: How to Take the Right Kind, Not Avoid It

Risk is not the enemy. It is the price of progress.

The goal of financial planning is to understand it and take it intentionally.

The Most Overlooked Wealth-Building Tool During Open Enrollment

Many companies are in the middle of open enrollment season so it is a great time to revisit the Health Savings Account (HSA)- a savings tool that is often overlooked but offers meaningful long-term benefits.

Which Retirement Income Style Are You?

Your Retirement income style determines how you will receive income for the rest of your life. It is important to establish a framework that supports your preferred income style before you retire.